[ad_1]

Nvidia Corp. was once a scrappy underdog. Founded in a Silicon Valley diner, the designer of graphics chips faced death more than once before finally realizing its founders’ vision of standalone semiconductors used specifically for displaying images on a screen.

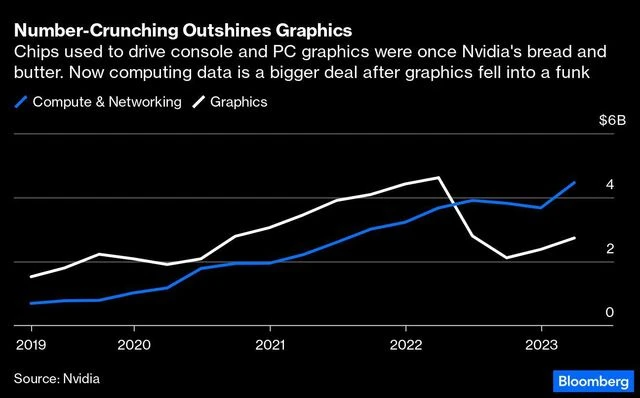

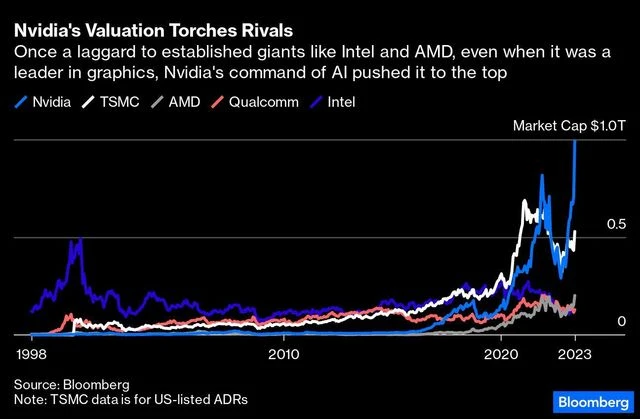

Having already surpassed storied titans Intel Corp. and Advanced Micro Devices Inc., the company’s market capitalization touched $1 trillion last week. Graphics didn’t get it there, though. A bet that its approach to number-crunching would be a perfect fit for the nascent artificial intelligence sector ensured that when startups and major tech companies finally caught the wave, Nvidia was there to sell them high-priced chips perfect for the job.

These five charts outline just how Nvidia made it to the top.

)

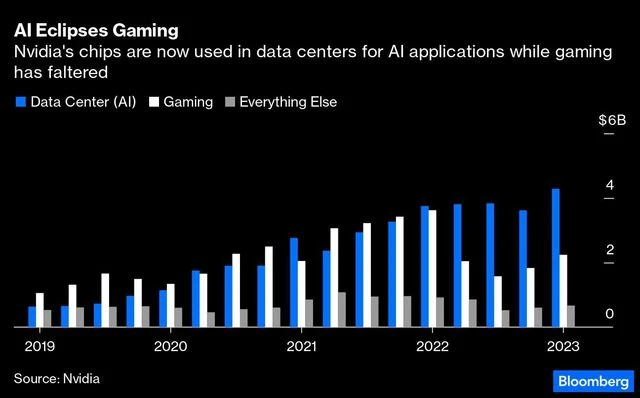

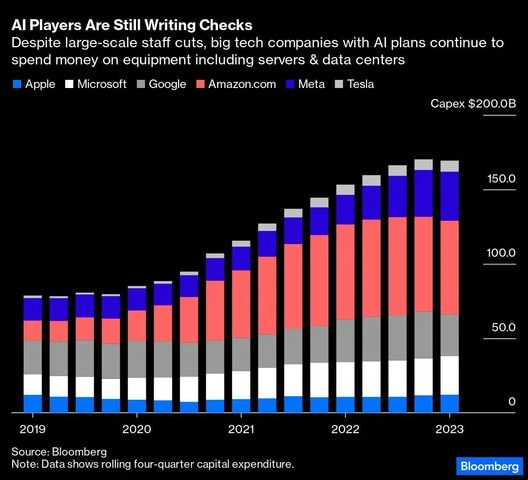

The company’s graphics chips are mainly used for gaming, alongside professional applications such as 3D design. But an increasing number of its chips are being installed in data centers to help companies like Microsoft Corp., Alphabet Inc., OpenAI, and Amazon.com Inc. build their AI capabilities and offer those services to clients.

)

)

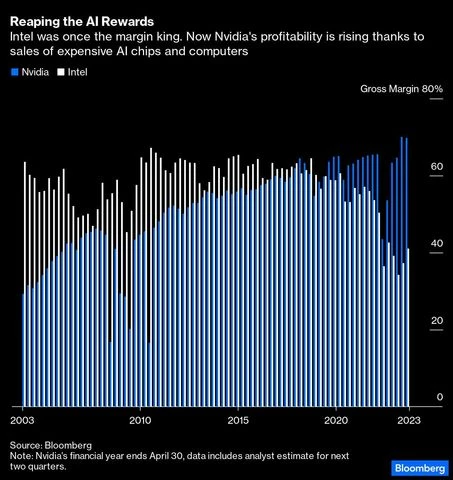

One way to assess a company’s technological prowess is to see how much pricing power it has with customers. That can be measured by looking at gross margin — the markup it makes atop the cost of building the product. Intel Corp.’s heyday was during the PC and laptop eras. Today Nvidia holds the crown, with the high profits on AI chips and computers driving it to record profitability.

)

)

Disclaimer: This is a Bloomberg Opinion piece, and these are the personal opinions of the writer. They do not reflect the views of www.business-standard.com or the Business Standard newspaper

[ad_2]

Source link