[ad_1]

Source: American Express

American Express is evolving their app experience for consumers. To facilitate the use of its new high-yield checking account, the company is looking to provide a seamless, intuitive experience that melds its banking and credit card products into one app.

“Our mission is to be essential in our customers’ digital lives by providing value, convenience and delight,” Ashish Pawale, vice president of global mobile engineering at American Express, told ZDNet.

The redesign team wanted to make the new app experience as easy and convenient to use as possible by using one app for both banking and credit card customers. Beginning with the savings account AmEx introduced in 2021, the team saw it as a good opportunity to roll out visual and technical changes.

“I think it was really vital for us to think beyond the card experiences that were already the central part of the mobile app,” Johan Alexandersson, director of product design for global mobile at American Express, told ZDNet. “As the conversation started around the checking account, we saw the opportunity to push this further and start to think about, more from a wider point of view, when it comes to different types of products that could potentially be integrated into the mobile app,” he said.

In order to meld the credit card-focused app with the consumer checking account, the team had to create a new login and authentication process. Being the first thing customers interact with, it was important to get right. The company had a few things in mind when approaching the redesign.

Also: The Platinum Card® from American Express review

“When you’re a customer, and you log on to the app, what does that experience look like? How do you put all of these products in one place, and how do you allow customers to move seamlessly between products?” Delma Quash, vice president of product management for AmEx Mobile, said.

With the influx of digital consumers since the pandemic, it was important to provide customers with an attractive and easy-to-use application for them to control their funds. And though it is early, Quash said what they’ve seen so far with customer engagement and the numbers of clients coming in after rolling out a few updates has been positive.

The inspirations behind the new checking account

The creation of the all-digital checking account was also, in part, created to attract Millennials and Gen-Z consumers, as research shows they’re more likely to use debit cards over credit cards or cash.

The checking account includes a debit card that earns 1x Membership Point for every $2 spent and features a high annual percentage yield (APY) of 0.5%.

“If you look at Millennials and Gen-Z, they like to use debit cards instead of cash. And, of course, they want to use digital products. Along with customer satisfaction and customer engagement, these are our key priorities,” Pawale said.

The industry demand — and customer expectations — for digital banking was gaining momentum pre-pandemic. It was bolstered during the COVID-19 pandemic and isn’t likely to decrease post-pandemic, Quash said.

In fact, a recent J.D. Power study found that 80% of digital consumers plan to stay digital after the pandemic ends.

“The expectation is that you will have a digital banking experience, and so our job really is to respond to that expectation and create this holistic experience where you can have a complete self-service without having to walk into a bank,” Quash said.

When asked if the team plans to integrate any financial wellness resources into the app for the younger generations they’re trying to entice with the new products, they said it’s an evolving process.

Also: American Express launches digital, high-yield consumer checking account with few fees

“It’s incredibly important for us to go through not just rigorous testing of the experiences that we do release, but also, really listen to our customers. Because at the end of the day, they are the experts on the experience they want, and that includes, of course, [financial education resources],” Alexandersson said.

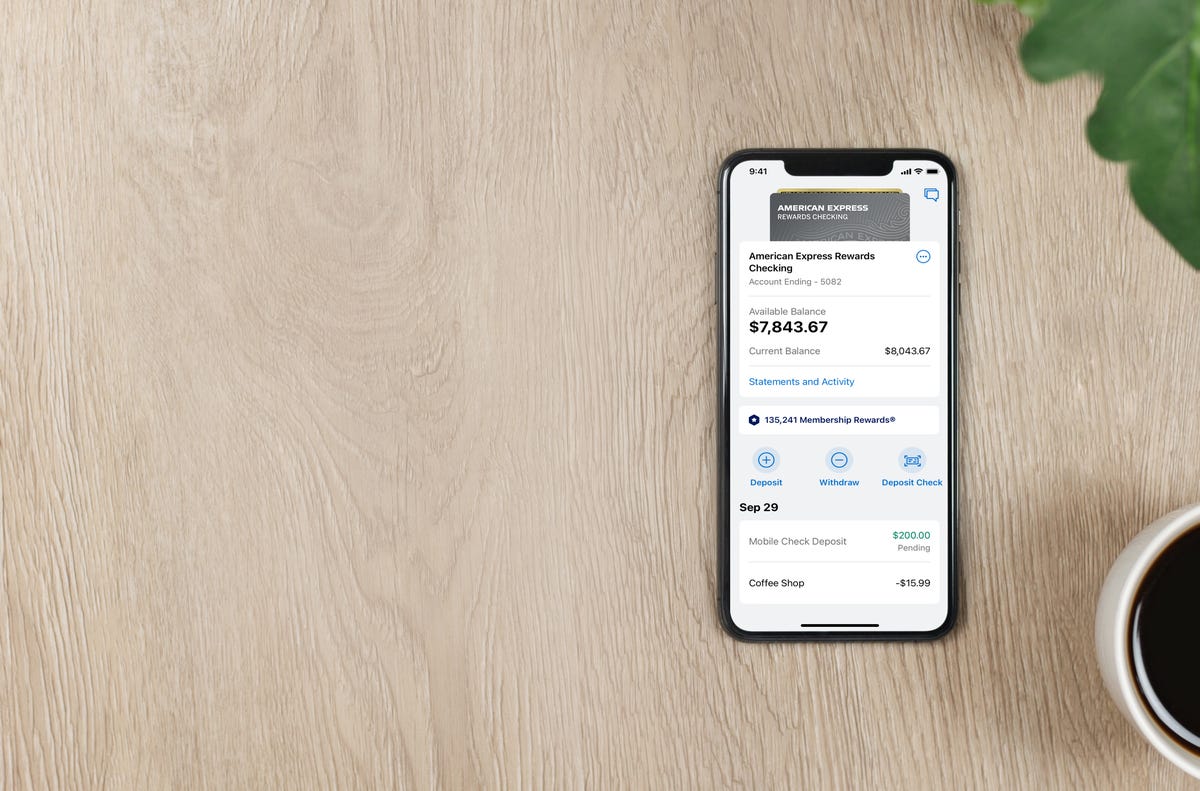

Source: American Express

Checking account and app features

One of the key features of the checking account is the ability to link outside bank accounts to it and transfer funds between them. The Money Movement program, Quash said, is one of the best new features of the account, along with its industry-leading APY.

The checking account comes with a debit card that rewards cardholders for every transaction (1x point per $2 spent). It also features Purchase Protection, safeguarding consumer purchases more so than a typical debit card would. The Membership Rewards points the card earns can be deposited into the checking account, and each point is worth 0.6 cents.

There are more features on the way, like an intelligent search feature that’s currently being tested in the U.K. The search feature is intended to help users find exactly what they need, as the app has a lot of features to sift through.

The team indicated the checking account and app features will be an evolving process fueled by customer feedback. “It’s an evolving experience, and we look to roll out a lot more throughout the year and beyond,” Quash said.

[ad_2]

Source link