[ad_1]

PayPal

Buy Now, Pay Later (BNPL) services offer flexible payment terms at a time when many of us are facing rapid inflation in the cost of living — and while there may be short-term relief, there are also long-term consequences to consider.

BNPL offerings are now plastered across thousands of e-retailer websites, including clothing stores, beauty and makeup vendors, home products, technology stores, DIY, toy manufacturers, and even grocery shops, with partner brands including popular vendors such as Samsung, PrettyLittleThing, and ASOS.

You can now encounter BNPL when you are buying “luxury” goods as well as making necessary purchases, representing a potential shift in the market and the rapid adoption of this payment method.

A Citizens Advice survey conducted in March 2022 found that one in 12 people have used BNPL to cover essential goods, such as food and toiletries.

These services allow you to spread the cost of purchases over several weeks or months. However, unless used responsibly, they may also fast-track you into unsustainable debt or leave marks against your credit report that will haunt you far into the future.

A growing industry

BNPL is projected to be the world’s fastest-growing payment method both online and in-store between 2021 and 2025, according to Worldpay’s 2022 Global Payments report.

By 2025, BNPL is expected to account for 5.3% of global transaction value, or approximately $438 billion. Considering the current economic uncertainty and the cost of living, this might be a conservative estimate.

How does Buy Now, Pay Later work?

BNPL varies from provider to provider. However, they generally act as middle-man lenders and financial services, offering a line of credit for purchases made at third-party stores.

They offer short-term financing options, usually in installment loans fixed over agreed periods. The BNPL provider and consumer may agree to weekly payments, a payment every two weeks, or a payment every month.

You will usually spot Buy Now, Pay Later options at e-retailer checkouts. You will be asked if you’d prefer to break up the initial cost of a product into smaller payments over time — the most popular offering currently being a ‘pay in four’ installment model — and after a quick sign up process asking for basic information, users can be approved or denied in a matter of seconds.

Popular BNPL service providers include Klarna, AfterPay (also known as Clearpay in the EU), Affirm, PayPal’s Pay in 4, and Sezzle.

In almost every case, these services highlight flexible payments and no interest or service charges.

For example, you could buy an $800 laptop and use a BNPL service to pay a deposit of $200 and then the rest of the balance in three equal installments every two weeks.

BNPL may also provide traditional loan and credit agreements, including interest (an APR percentage tacked on), for more expensive purchases.

The Ascent conducted a study between 2020 and 2021 that surveyed US consumers on BNPL use. It revealed that 55.8% of consumers said they have used Buy Now, Pay Later, with the highest growth recorded in the 18 – 24 and 55+ age brackets. Survey respondents also said their usage increased due to the pressures of the pandemic, and a quarter said it was due to lost income.

Klarna

A case study: Klarna

“Split any purchase into four interest-free payments. Online or in-store, it’s easy with Klarna,” – Klarna

One of the most popular Buy Now, Pay Later services out there, Klarna offers its users payment plans for online or in-store purchases.

The Klarna app works like this: A consumer makes a purchase and they can choose to pay in either four installments, within 30 days, or under the terms of a more formal finance agreement of between six and 36 months for “high-ticket items” (where the default risk to Klarna as a lender may be higher).

Users receive alerts before payment due dates and can extend their repayment timeline by ten days, otherwise known as “snoozing” a payment, once per order.

The Klarna mobile shopping app includes a catalog of thousands of sites implementing the BNPL service, further increasing the potential customer pool of these websites and the service itself. Partner vendors include Sephora, Wayfair, Macy’s, Nike, Halis Lingerie, Workwear USA, The Lexington, Converse, and Vans. Users can also join the Vibe ‘reward club‘ and loyalty program for discounts.

“Klarna customers have a spending limit vs the types of open lines of credit you get with a credit card,” Klarna told ZDNet. “And, our small, short-term loans are connected to an individual purchase which means if a customer shows they can spend and repay responsibly, that limit will be increased next time which is a more sustainable model. However, if a customer can’t pay us back on time and in full we will restrict the use of our services until any missed payments are fulfilled to prevent them [from] accumulating debt.”

“This is in stark contrast to credit card companies who give customers a high credit limit which can be spent all at once and can even be extended further without taking into account someone’s financial circumstances changing.” – Klarna

Klarna says it accounts for more than 147 million shoppers worldwide, two million daily transactions, and has more than 400,000 retail partners. The company also boasts a 41% increase in average order value and a 30% increase in conversion rates for affiliate businesses.

What are other popular services?

Afterpay/Clearpay: Afterpay offers a four-payment financing solution spread over six weeks.

The Afterpay app includes budget monitors, a way to set spending limits, and as repayments are made, the maximum amount of financing a user can apply for may increase. Spending limits tend to start at around $500.

Afterpay may conduct a soft credit check on signup. Afterpay Buy now, Pay Later payments do not impact credit scores, as they are not reported.

There are no upfront fees or interest added to the cost of purchases. However, late fees may apply, and missed repayment dates may impact future borrowing potential with the company. Afterpay stops users from making further purchases if a payment is missed and technology is used to also try and prevent overspending.

According to the firm, “half of all first-time purchasers and 30% of all purchase attempts” are blocked to stop overspending.

Capped late fees start at $10 but don’t go higher than 25% of an order value, and accounts may also be suspended until late payments are paid off.

Brand partners include Ray-Ban, Adidas, Ultra Beauty and SHEIN.

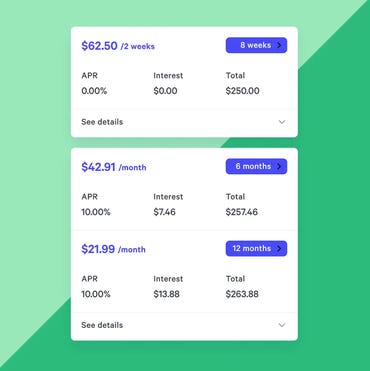

Affirm: Affirm‘s BNPL model is four interest-free payments spread out every two weeks, or for “big-ticket items,” monthly installments can be made. The BNPL service appears at online checkouts, although customers can also request virtual cards if Affirm is not offered at a preferred outlet.

This company doesn’t charge late fees but notes that “if you decide to buy with Affirm, these things may affect your credit score: making a purchase with Affirm, your payment history with Affirm, how much credit you’ve used, and how long you’ve had credit.” If payments aren’t made after 120 days, the company may charge off the loan.

APR rates at payments made every two weeks are 0% but interest is added if monthly options are selected. For example, Affirm’s online calculator (illustration only) shows 0% APR on a $1000 purchase if payments are made every two weeks, but a 15% APR is imposed on a six- or 12-month repayment term. Time frames range from six weeks to 60 months.

As of December 2021, 44% of loans were granted at 0% APR.

“Your rate will be 0% APR or 10% to 30% APR based on credit, and is subject to an eligibility check,” Affirm says. Purchase amounts of up to $17,500 may be offered, although a deposit could be required at the higher end of lending.

Partners include Walmart, Peloton, Amazon and Expedia.

The company has also opened up a waiting list for Affirm Debit+, a physical debit card for everyday shopping at 0% APR that also offers payment in installments.

PayPal Pay in 4: PayPal’s Pay in 4 service is a bolt-on to the tech giant’s main payment processing business. As a payment solution backed by PayPal, it can be accessed at the “pay using PayPal” checkout stage and used at millions of online stores including Coach, Bose, Best Buy and Target. Payments can be made via the firm’s standard app.

PayPal Pay in 4 purchases are set between $30 and $1,500, interest-free — subject to approval — and a soft credit check may be required.

There are no late fees but PayPal’s terms of service say, “if you miss a repayment your credit rating and credit score may be affected in a way that impacts your ability to obtain further credit.”

Future use of the BNPL feature may also be restricted.

“PayPal takes the financial health and wellness of our customers very seriously and strives to help them by providing payment flexibility,” PayPal told ZDNet. “When someone applies for a buy now, pay later loan, we use a variety of sources to determine their creditworthiness including, but not limited to, PayPal proprietary data, past PayPal buy now history, and credit checks.

Post loan approval, we provide frequent communications about upcoming payments, payments made, and never charge late fees for missed or late payments.”

Sezzle: Sezzle operates a pay-in-4 model with no interest fees and calls itself “your stress-free solution to financial freedom.”

Sezzle sets spending limits through an algorithm that considers “a variety of factors during the approval process, including how long you’ve been a Sezzle shopper, the information you provided at sign-up (soft credit check), and your order history with Sezzle.”

Spending limits, and order acceptance, are in the hands of Sezzle’s automated system.

“Every purchase attempt and approval is completely automated and the Sezzle Support Team is unable to manually approve any orders or increase spending limits. Our automated system does not approve 100% of orders.” – Sezzle

Users can pay over six weeks, there are no fees when repayment schedules are maintained, and customers may earn cashback through partner retailers. Affiliates include Miik, BlackWolf and Perfectly Posh.

Sezzle may charge a fee if a payment is missed, customers reschedule a payment for a second or third time, or an account is blocked due to missed payments and is reactivated.

It is possible for multiple fees to be added to one order and the company “reserves the right to initiate payments and withdraw funds from any bank account(s) on file at any time in order to collect all payments, including delinquent payments.”

What are the advantages of Buy Now, Pay Later?

As we’ve shown above, some BNPL services focus on providing APR-based credit lines for high-ticket items to generate revenue, others will impose late fees, and some leverage their massive customer bases to make money from merchants through sales commission models.

So, what’s in it for today’s shopper?

There’s you, the consumer, and the merchant. You’re expected to pay for a product there and then, but instead, a middle-man lets you pay a percentage and then spread the cost out over an extended period.

This flexibility can benefit many of us, especially in a high-inflation economy. BNPL providers also try to ensure it is a quick purchase and credit agreement process, their platforms are user-friendly, and simplicity is king.

Buy Now, Pay Later agreements also don’t implement the typically time-consuming, and somewhat frustrating, pages of forms to fill out when you apply for traditional credit.

Many BNPL services offer interest-free financing and may also offer frequent customers’ loyalty points toward future purchases or other reward programs.

However, Buy Now, Pay Later is still a financial product with terms and conditions, and so contract terms must be understood before you make a decision that could cause you stress or anxiety later on.

What are the disadvantages of Buy Now, Pay Later?

- The ease of use when it comes to these services could lure consumers into spending more than they can afford, especially if purchases pile up.

- If the funds aren’t in your bank account to cover the repayments, this can lead to late fees, penalties, account restrictions, and negative credit spirals.

- Unlike many other forms of financing, BNPL services won’t generally contribute to improving your credit score.

- There may be a lack of transparency or understanding over how BNPL services operate.

- BNPL is not under the same oversight by regulators as traditional and established financial products.

Another serious issue with BNPL is that many consumers do not realize that Buy Now, Pay Later is still debt.

BNPL offerings are credit agreements and are defined as unsecured loans, although this area can appear to be murky as credit bureaus and vendors treat its credit impact differently — and not every BNPL service is regulated.

The UK Financial Conduct Authority (FCA), for example, doesn’t regulate these agreements under consumer credit regulation law but does enforce consumer protection legislation.

The FCA has expressed concern over consumer understanding of BNPL agreements. As a result, Clearpay, Klarna, Laybuy and Openpay agreed to change the terms in their consumer contracts this year “to make them fairer, easier for consumers to understand, and to better reflect how they use them in practice.”

A UK survey conducted this year by Creditspring said that 81% of borrowers are unaware that BNPL is generally unregulated, and roughly a third of those surveyed did not consider BNPL as a form of borrowing.

More than half – 53% – didn’t realize that debt can pile up if payments are missed. Furthermore, 43% of respondents said they were not aware that late payment fees could be imposed.

One in seven of those surveyed believed it was “impossible” to get into debt using Buy Now, Pay Later, which is a startling figure considering how widespread these financial products now are.

However, many BNPL services, including Klarna and Afterpay, say that delinquent payments are rare. Afterpay told us:

“The service is completely free for customers who pay on time — helping consumers spend money responsibly without the risk of accruing extended or revolving debt.

Our proprietary risk models have been proven to protect our customers. 98% of payments are made on time and do not incur late fees. We promote and enable responsible credit use by pausing accounts from future purchases if a payment is late and by capping late fees. These built-in safeguards mean that Afterpay customers are actually half as likely to be delinquent than credit card customers.

This allows consumers to avoid using expensive loans and credit cards, which can lead to revolving debt.”

How is Buy Now, Pay Later different from credit or store cards?

- Credit cards tend to have fixed borrowing amounts, whereas BNPL increases once purchase responsibility is proven.

- BNPL takes minutes for approval, whereas applying for credit cards is generally a longer process.

- Credit cards, with the exception of balance-transfer cards, normally charge interest as standard — BNPL does not.

- Late payments and defaults on credit cards usually appear on your credit reports, whereas BNPL may not.

- Payments made on credit cards, on time, can boost your credit score — BNPL providers usually don’t report made payments.

- Store cards are considered more traditional and the terms are set by retailers. BNPL services offer ‘loyalty’ discounts and programs more widely and may be the ones to negotiate retailer promotions on their platforms.

- Store cards often offer loyalty points and discounts for only one family of retailers, whereas BNPL can include thousands of stores.

A younger consumer base

BNPL providers spotted an opportunity in the market to take finance and lender agreements out of the past and integrate them with new technologies attractive to modern consumers.

Arguably, BNPL services are trying to secure the younger generations of shoppers through mobile technology, apps and the brands they partner with, such as H&M, Nike and Sephora. This is even achieved through catchphrases like “vibe” (not something you’re likely to see on the website of Wells Fargo or City National Bank).

Klarna says that 70% of its users are Gen Z and Millennials, the generations that have grown up with the internet, mobile technologies, apps, and social media-driven advertising and marketing.

Traditional financial products just don’t always cut it anymore. Younger consumers may now expect quick transactions, a seamless experience, and convenience — and when older forms of credit fall short of these expectations, BNPL services step into the breach.

An example BNPL agreement

Affirm

Speaking to ZDNet, Geoff Kott, chief revenue officer at Affirm said:

“We purpose-built our technology to work for consumers and merchants alike, and our success is fundamentally aligned with the people we serve. Inflation and the rising cost of living might reduce some consumers’ spending power, but Affirm can help them get that back.

Because we never charge a penny more than what the consumer agrees to at checkout, our success depends upon lending to consumers responsibly.

Overextended consumers are not good for Affirm, not good for our merchants, and most importantly are not good for the consumer we serve, especially as our mission is to help improve their financial wellbeing, not risk it.”

Afterpay has a similar attitude to lending. The company told ZDNet:

“Millennials and Gen Z are showing a strong preference for debit over credit cards, allowing them to budget and control their own money.

Afterpay is flipping the traditional payment model on its head. Our platform actually makes more money when consumers pay on time and spend responsibly vs. expensive credit cards, in which their business model is designed to keep consumers paying expensive fees and interest.”

When it comes to grabbing the attention of customers, companies now have to compete on a global and digital scale. Offer short-term financing deals rather than just loyalty points, and you potentially have more of a chance to secure new and reoccurring business.

Speaking to ZDNet, Modern World Business Solutions financial analyst Jeremy Helm said:

“Technology is normally the key factor to financial disruptors, as can be seen with the growth of cryptocurrency as a great alternative solution to many previously held issues, whereas in regards to the growth of BNPL, it has largely been a cultural switch due to unforeseen circumstances around the pandemic and impact it had on our purchasing decisions and short term financing needs.”

Does Buy Now, Pay Later remove barriers to purchase?

“At Klarna we’re on a mission to make your shopping experience as smooth as possible,” – Klarna

Buy Now, Pay Later is often packaged up as a payment option that is more “flexible” than traditional finance. As Klarna says, BNPL enters the purchase process in a way that is as seamless as possible.

Consider e-commerce baskets. You select the item you want, click ‘Add to basket,’ and then go through several steps before purchase completion.

Retailers know that every step — or ‘barrier to purchase’ — heightens the risk of an abandoned shopping basket. So while they may have a chance to lure you back with a discount offer sent over email or via an app notification (and some shoppers will use this tactic to their advantage and snag a cheaper deal by abandoning a basket and waiting), the more seamless the transaction, the higher the sales conversation rate.

The same lesson can be applied to the purchase step. Again, the more frictionless the process, the higher the conversion — and BNPL providers may try to remove some buyers’ “immediate affordability” concerns, thereby also potentially increasing the sales value.

How do Buy Now, Pay Later services make money?

The lure of BNPL isn’t just convenience. Avoiding the fees and interest payments associated with credit cards or store credit is also important.

It’s enough to make you suspicious, though — if I’m not paying for the service as a customer, who is?

The answer is that the service costs are often passed on to merchants: BNPL organizations draw in more customers and sales conversions, and in return, BNPL takes a percentage of the transaction or a straight fee per customer purchase, comparable to a commission.

In itself, merchants may ‘pay’ to work with services such as Klarna or Afterpay in return for targeted marketing, access to mobile users, and a wider potential customer reach.

This doesn’t mean that the consumer gets away with paying nothing. BNPL providers may charge interest or impose penalties when payments are late or missed entirely.

If more traditional financing options are on offer, there is also a mix of retailer fees and interest charges for the consumer. In Klarna’s case, up to 18.9%, APR is on the table, for example, and Affirm may charge interest of up to 30% APR on longer repayment terms.

“Shop now, pay later at thousands of retailers across the globe. Don’t let us keep you — browse our shop directory and go after the good stuff today,” – Afterpay

Does Buy Now, Pay Later impact my credit score? Should I care?

The attitude toward credit scores depends on the BNPL financial service provider. The typical practice is to perform a soft check (or “pull”) on applicants for Buy Now, Pay Later financing, as part of a background scan to bring up any serious red flags, or indicators of potential fraud, before offering someone a line of credit.

Soft checks won’t impact your credit score but may be recorded on your file.

Hard checks (or pulls) are performed for more stringent forms of financing, such as for high-value loans, car financing or mortgage applications, and if you’re asking a BNPL provider for traditional finance agreements, they may perform a hard check. (This doesn’t include ‘Pay in 4’ models, at present).

Hard pulls can temporarily impact your credit report and overall score.

Not every BNPL provider will run a credit check. Afterpay, for example, approves transactions based on purchase history and spending limits and doesn’t report late payments to credit bureaus.

“We don’t believe in preventing people from accessing Afterpay because they may have had an old debt from a long time ago. And we don’t believe that missing a payment with Afterpay should result in a bad credit history,” – Afterpay

However, many BNPL services can still impact your credit score if you miss payments or do not settle your balance.

When used correctly as a form of financing, BNPL can arguably strengthen a credit score as it is a line of credit — but only if the service provider reports ‘met’ payments to credit agencies, and many don’t.

In other words, if you want to use BNPL purely to build your credit, it’s unlikely to be worth it.

What happens if I can’t pay?

“Unlike with credit cards, every time a customer uses our BNPL options, we perform a strict eligibility assessment, including a soft credit check to ensure we only lend to people who can afford to pay us back on time and in full. Our business loses out if they don’t, so we have no incentive for people to miss payments,” – Klarna spokesperson

While many BNPL services market themselves heavily as having no interest payments or penalties, the lesson has to be brought home: these benefits only apply when payments are made and on time.

The Ascent’s study found that 45% of BNPL users make purchases outside of their budgets, and 31% of BNPL users have either made a late payment or incurred a late fee.

However, instead of charging an initial late fee, Klarna, for example, will try to retake payment if an initial attempt fails. If the second attempt fails, the balance is added to the next scheduled payment.

Late fees may be added if payments can’t be collected, and customers may also be prevented from using Klarna until the debt is paid.

BNPL amounts owed don’t just vanish if you can’t pay.

Financial product providers and lenders operate BNPL services. As such, you are bound to any terms set in an agreement you consent to — and if you don’t hold up your end of the deal, there can be the same consequences as with more traditional financial agreements.

Klarna, alongside other BNPL providers, is entitled to forward cases to debt collectors, if necessary, although the company insists they “do not use enforcement agencies or bailiffs and neither do our debt collection agencies.” Instead, Klarna says that debt agencies are used to “make contact with customers.”

Klarna told us:

“The protections we have in place mean that over 99% of Klarna purchases are repaid in full, which is 30 to 40% below industry standards and traditional credit cards.

We only ever use debt collection agencies to continue to help us make contact with the customer by telephone or email, and we do this with less than 1% or orders.

The Debt Collection Agencies we work with are all [UK] FCA authorized and we never sell debts to debt collectors for our Pay Later products. We specifically instruct the DCAs we work with that they cannot use bailiffs, initiate litigation, or legal action so no country court judgments either. This means we retain control over the potential impact to customers and can ensure there is no impact on credit scores and no use of enforcement agencies.”

Continually failing to pay could result in some BNPL providers charging the outstanding balance in full to the customer’s linked payment card, and late or missing payments may be submitted to credit agencies, resulting in a mark against you on your credit file.

Should I use Buy Now, Pay Later for purchases?

In summary:

- BNPL offers more flexibility in paying for goods online and in-store.

- There is the possibility of no-interest, short-term financing.

- Ease of use, mobile technology and strategic partnerships are geared toward younger shoppers.

- There are still consequences if you fail to pay, including potential fees or contact from debt collection agencies.

- BNPL may impact your credit score if you don’t stick to repayments.

- BNPL can be a useful financial tool, but if abused, it may encourage high levels of spending and debt.

Flexible payments have a place in today’s economy. Unfortunately, sometimes everything goes wrong in the same month, the kids need new school uniforms, the car breaks down, the boiler has a tantrum, and an unexpected bill lands in the mailbox.

Sometimes, we need some help to get through until the next paycheck arrives.

However, despite how BNPL is marketed or how flexible repayment schedules are, the reality is that you can end up with serious financial problems if you use it irresponsibly or end up relying on it month-to-month.

While interest-free payments spread out over time are attractive, if payments aren’t made and cases are taken further, they may appear later in the form of debt collector defaults or similar marks against your name and credit file.

Many people today face a surge in the cost of living due to inflation, economic uncertainty and have little job certainty. This is especially important to highlight today, as the economy is still recovering from the nuclear economic damage caused by COVID-19, and we haven’t yet seen the full increase in the cost of living.

In a survey of UK consumers conducted by Walnut Unlimited in 2022, 52% of respondents aged between 18 – 24 and 53% of 25 – 34-year-olds said they are “less confident” that they can make their current BNPL payments as a result of the rising cost of living.

If you’re already struggling with debt and don’t have an emergency fund in place, using BNPL, just like payday loans or credit cards, may be useful in the short-term, but may also only exacerbate the problem long-term.

If you can’t meet the repayment terms of existing BNPL agreements, you should reach out to the company as they may be able to offer you new terms that are more affordable. Many, including Klarna, have teams dedicated to customers considered “vulnerable,” or as Klarna told us, “whose circumstances change and find themselves struggling to pay.”

Unfortunately, Buy Now, Pay Later could eventually become a necessity rather than a convenient payment solution to balance the monthly books for some consumers.

But still, they must be used with a budget in mind and not as a way to make financial troubles a ‘future you’ problem.

“With the cost of living at a thirty-year high, financial support for people and families living with debt is more important than ever,” commented Amon Ghaiumy, CEO of debt resolution firm Ophelos. “BNPL platforms which have become readily available for grocery purchases may ease some short-term burden for those who need it — offering greater flexibility and ensuring that families aren’t going hungry.”

“These services can not only offer individuals smart ways to budget but are potentially cheaper than high-interest credit cards or payday loans. However, as these services grow in popularity, there needs to be just as much support for people who end up in problem debt and cannot make their payments as there is at the time of purchase.

If technology makes it easier to pay and potentially build up debt, the same technology needs to provide support to those struggling to meet repayment dates.”

[ad_2]

Source link