[ad_1]

Searchmetrics’ analysis suggests Google may have stopped trying to increase competition on Google Shopping in the UK since the country left the EU under Brexit

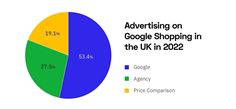

Five years after the EU commission fined Google 2.4 billion euros ($2.65 billion) and ordered it to open up its Google Shopping service in Europe to external competition, a new study suggests around 53% of ads on the platform in the UK, still originate from Google itself – up from around 49% in 2019. The research from Searchmetrics indicates that after Brexit, Google is no longer trying to increase competition on its shopping platform in the UK.

Advertising on Google Shopping in the UK in 2022

On top of this, the research suggests that most of the external participants on Google Shopping are not in fact the providers of genuine comparison-shopping services which Google’s action was intended to benefit. Many are marketing agencies that have emerged after Google’s fine. They sell ads on the platform’s auction system paying Google a margin and giving the impression of increasing competition.

Google’s Shopping platform displays product ads in search results related to the specific products people are searching for. In its 2017 antitrust action, the EU ruled that Google was giving itself an unfair advantage by promoting its own ads on the platform over those from rival comparison shopping websites which help consumers compare different products and prices to make informed purchasing decisions.

Searchmetrics’ latest study has reviewed over one million Google Shopping ad units across the UK and Germany to analyse the extent to which Google is complying with the EU’s call to introduce greater competition onto the platform.

By comparing the results to its previous studies, Searchmetrics concludes that Google had to some extent initially attempted to increase external participation in the UK. But since Brexit its efforts seem to be declining.

Lillian Haase, CMO of Searchmetrics, explained: “Our data suggests that Google’s share of UK shopping ads was around 68% in 2018. And in line with the EU’s call to increase competition this was brought down to 51% by 2019. However, since Brexit happened, Google’s share of ads in the UK has started to rise again, reaching 53% in 2022 so far. The trend clearly shows that after Brexit, the EU Commission’s demand for more competition no longer applies to UK search results.”

In fact, there are signs that there is even less real competition on Google Shopping. According to the data, of the 47% of Shopping ads in the UK which are not placed directly through Google, only 19% actually come from rival price comparison websites who were the intended beneficiaries of the EU’s action. The rest (28%) are mainly from performance marketing agencies that sell ads on the Shopping platform’s auction system giving Google a margin.

Google’s solution to addressing the lack of competition, has been to open-up participation to Comparison Shopping Services (CSS) who can take part in the online auction by bidding against Google for advertising positions on the shopping platform. These external providers can accept bids for ads from online merchants who want to appear in Google Shopping.

But according to Searchmetrics, while some CSS providers are genuine comparison websites, most are performance marketing agencies who offer comparison shopping services in name only. Many were formed after the Google fine in 2017. And while they may run comparison shopping portals, they only list the products sold by merchants whose bids they manage on the Google Shopping auction system – which means they are otherwise largely irrelevant for genuine comparison shopping. In reality, their only function is for Google to demonstrate that Shopping ads are shown from other publishers than itself.

“Even if at face value it appears Google has opened up Google Shopping ads to external providers, these comparison-shopping portals themselves offer negligible user value,” said Haase.

According to Searchmetrics’ analysis, the top 20 CSS partners in the UK have negligible organic search traffic, supporting the view that their primary function is in fact to sell ads on Google Shopping, and not to help consumers find products.

The research suggests that in Germany 33.6% of Google Shopping ads still originate from Google, down from around 50% in 2019 (and 67% in 2018). So, in Germany Google seems to be continuing to work towards reducing its own participation. However, the same issues exist as in the UK. The external ads come from CSS partners, with 41.5% placed via agencies, and only 24.9% from genuine price comparison websites who also function as CSS partners.

The Searchmetrics’ study, ‘Understanding Google Shopping Ads in 2022’, can be downloaded at:

https://www.searchmetrics.com/knowledge-hub/studies/google-shopping-study-2022/?utm_source=public-relations&utm_medium=external-media&utm_campaign=2022-05-en-study-google-shopping-2022

-Ends-

About the study

The study analysed search results and Google Shopping ads that appeared for a database of shopping related keywords. The keyword set was defined based on common product categories and search terms. Keywords that intrinsically involve a particular retailer or place to buy those products were filtered out, as were branded keywords. This step aims to avoid any unfair bias towards a particular retailer. (Example “best Bluetooth headphones” vs “Amazon best headphones”)

The keyword has a roughly even split across product categories both in terms of overall search volume and also in numbers of keywords. For the UK, 650,000 shopping ads and 280,000 organic results were analysed. For Germany 400,000 and 240,000 organic results were analysed.

About Searchmetrics

Searchmetrics is a global provider of search data, software and consulting solutions. Its innovative approach ensures household names like AXA, Lowe’s and McKinsey & Company thrive in the hyper-competitive search landscape.

Searchmetrics enterprise offerings turn data from search into unique business insights that fuel clients’ continued growth.

Searchmetrics Suite delivers data-driven insights to maximize search and content performance. Its four modules: Research Cloud, Content Experience, Search Experience and Site Experience contain the tools SEO professionals, content marketers and digital specialists need to grow their organic search into a major driver of revenue.

The Digital Strategies Group is a team of data, SEO and content consultants who guide the world’s largest brands to excellence in digital marketing.

Searchmetrics Insights offer new sources of market research through exclusive metrics and analysis derived from search data.

Searchmetrics API allows enterprises to enrich BI or data warehouse applications with search engine rankings, keywords, content data and other marketing analytics.

More info: www.searchmetrics.com.

Press Contact:

Nadja Schiller

Searchmetrics GmbH

Director Global Marketing Communications

+49 30 322 95 35 – 52

[email protected]

Uday Radia

CloudNine PR Agency

+44 7940 584161

[email protected]

[ad_2]

Source link