[ad_1]

By Preeti Singh and Divya Patil

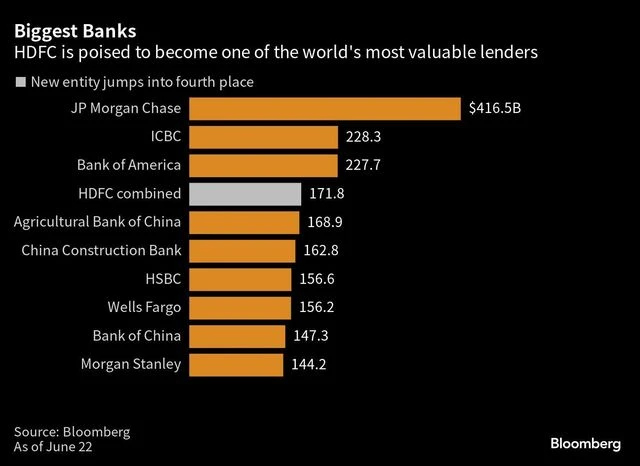

A homegrown Indian company will for the first time rank among the world’s most valuable banks after completing a merger, marking a new challenger to the largest American and Chinese lenders occupying the coveted top spots.

The tieup of HDFC Bank Ltd. and Housing Development Finance Corp. creates a lender that ranks fourth in equity market capitalization, behind JPMorgan Chase & Co., Industrial and Commercial Bank of China Ltd. and Bank of America Corp., according to data compiled by Bloomberg. It’s valued at about $172 billion.

With the merger likely effective July 1, the new HDFC Bank entity will have around 120 million customers — that’s greater than the population of Germany. It’ll also increase its branch network to over 8,300 and boast of total headcount of more than 177,000 employees.

In the charts below, we highlight the scale of this global banking giant and examine some of the challenges ahead for its stock price.

Market Capitalization

HDFC surges ahead of banks including HSBC Holdings Plc and Citigroup Inc. The bank will also leave behind its Indian peers State Bank of India and ICICI Bank, with market capitalizations of about $62 billion and $79 billion, respectively, as of June 22.

)

Chart

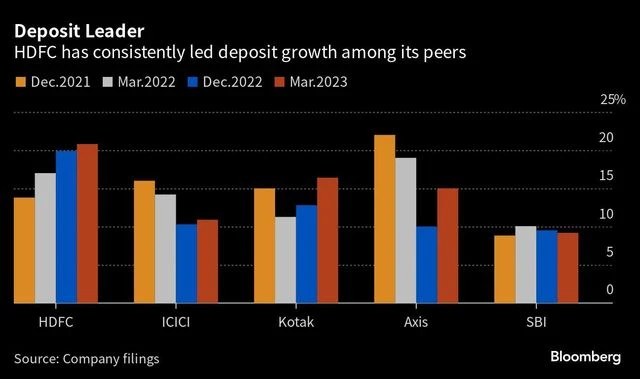

Deposit Growth

HDFC Bank has consistently outperformed its peers in garnering deposits and the merger offers another chance to grow its deposit base by tapping the existing customers of the mortgage lender. Some 70% of those customers do not have accounts with the bank. Arvind Kapil, retail head at the bank, last month said he plans to get them to open a savings account.

The lender will be able to offer inhouse home loan products to its clients as only 2% of them had a mortgage product from HDFC Ltd., according to a presentation when the merger was announced.

)

Chart

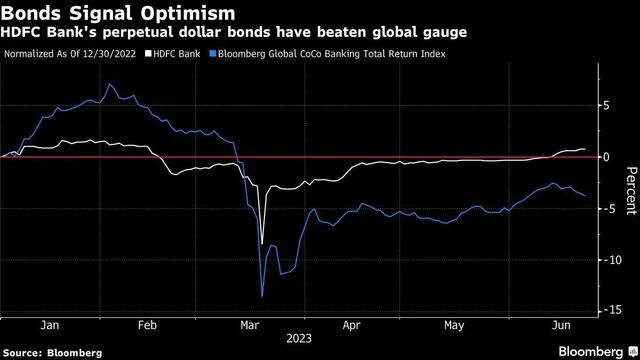

Confidence Check

HDFC Bank, which counts JPMorgan among its largest investors, is enjoying high levels of investor confidence. Its contingent convertible bonds — the riskiest type of debt that can convert to equity if a lender runs into trouble — has outperformed its global peers. The perpetual dollar notes of HDFC Bank handed investors a return of 3.1% so far this year, even as Bloomberg’s index of global banks’ coco bonds lost 3.5%.

)

Chart

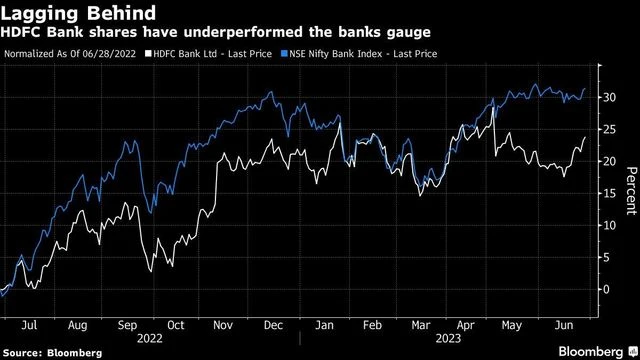

Stock Performance

HDFC Bank shares are up less than the NIFTY Bank index over the past year. Ganapathy, the Macquarie analyst, reckons the stock’s performance will depend on the growth of the loan book at 18% to 20%, and a 2% return on assets.

)

Chart

[ad_2]

Source link