[ad_1]

By Tania Chen and Ronojoy Mazumdar

JPMorgan Chase & Co. will likely include India’s sovereign bonds on its indexes next year as investment hurdles get resolved, one of Europe’s biggest asset managers said.

“According to our meeting with the index provider, India is keen on that inclusion even though it may not appear so to the outside,” Sabrina Jacobs, a senior client portfolio manager for emerging-market fixed income at Pictet Asset Management SA, said in an interview. “We are looking at mid-2024 as a start for the inclusion and then a phase in.”

India has in recent years come close to opening its $1 trillion government debt market to more global funds before pulling back from meeting the requirements for index inclusions. It’s the world’s last big emerging market that hasn’t joined others like China on the international gauges, with policymakers concerned about hot money inflows.

)

JPMorgan is expected to unveil the results of its index reviews by October. Last year, it said investors wanted issues resolved such as a lengthy registration process and operational readiness required for trading, settlement and custody of assets onshore.

Despite the operational difficulties, the provider may go ahead with the inclusion to diversify index constituents, Bank of America strategists said last month. Russia’s invasion of Ukraine had seen it lopped off indexes, while geopolitical tensions have made China’s sovereign debt less appealing.

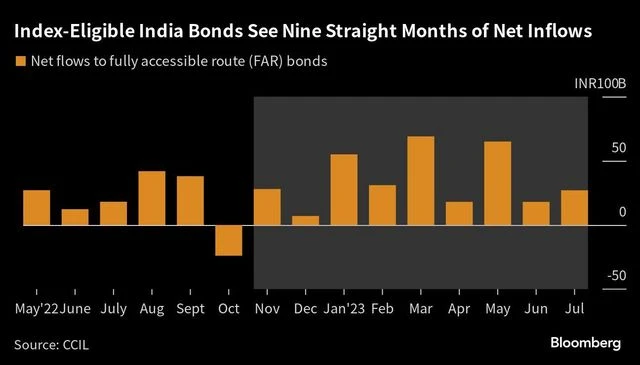

As India’s index inclusion hopes resurface, foreign investors have bought $3.8 billion of index-eligible bonds, or the Fully Accessible Route (FAR) notes, this year, nearly double the inflows received in 2022. Yields on 10-year government notes have fallen 12 basis points this year to 7.20%.

Inflows will help lower borrowing costs, which will support Prime Minister Narendra Modi’s infrastructure spending plans to power economic growth.

“It’s definitely an economy that is doing very well and growth is fairly domestically driven,” said Jacobs, who added the fund likes and owns India’s bonds.

Bloomberg LP is the parent company of Bloomberg Index Services Ltd, which administers indexes that compete with those from other service providers.

[ad_2]

Source link