[ad_1]

Tata Power’s plans to reduce debt by hiving off its renewables energy businesses into an infrastructure investment trust (InvIT) has missed the March-end deadline.

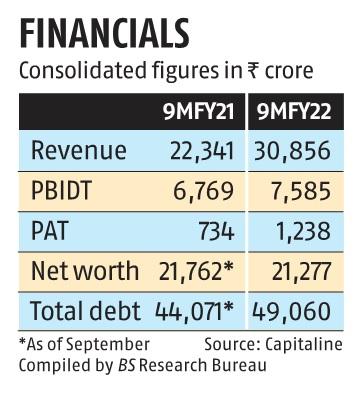

The company was planning to bring down its gross debt to below Rs 25,000 crore from Rs 49,000 crore with the InvIT structure.

The earlier deadline mentioned by Tata group chairman N Chandrasekaran was March 2021 but due to the Covid-19 disruption, the plan could not take off.

InvITs own, operate and manage operational infrastructure assets.

The cash flows from the businesses owned by the InvITs are distributed among the unitholders.

In the financial year ending March this year, Tata Power had re-started talks with several potential investors, including Petronas and Brookfield, but could not close the transaction.

Tata Power Renewable Energy (TPREL), a subsidiary of Tata Power, is currently leading the power firm’s initiative to increase non-fossil generation to about 60 per cent of its total capacity by 2025.

The combined portfolio of TPREL and Walwhan Renewable Energy generate around 2.7 Gw, making it a significant proportion of Tata Power’s generation capacity of around 30 per cent.

“The company may look at listing Tata Power Renewable Energy on the stock markets to reduce debt,” said a banker close to the development.

Tata Power shares closed at Rs 283 a share on Monday, up 1.73 per cent.

An email sent to Tata Power did not elicit a response till going to press.

Tata Power’s credit profile is considered a high carbon transition risk. This is because a significant part of its generation business is reliant on coal-fired generation (69.5 per cent), rating firm Moody’s had said in November last year.

However, Tata Power’s commitment to not add any new coal-based capacity, phase out the existing ones once their power purchase agreements expire and significantly increase its renewable energy footprint provides clarity regarding its carbon-transition plan, Moody’s added.

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

[ad_2]

Source link