[ad_1]

As of January 2022, a new Bankrate survey shows that less than half of Americans have enough savings to cover just a $1,000 expense. It is a concerning statistic that shows that not enough people are taking their savings seriously – a problem that will grow that much larger in the event of an emergency.

But where does one start? That is where we come in. We regularly survey the leading banks in the U.S. to find the best savings account for you and your family.

This is what we found.

Ally High Yield Savings Account

Best online savings account overall

Features and fees

- APY: 0.50%

- ACH transfers: $0

- Excessive transaction fee: $10 per transaction

- Incoming wires: $0

- Monthly fee: $0

- Outgoing wires: $20

- Returned deposit item: $7.50

Ally’s High Yield Savings is our pick for the best savings account because it has few fees matched with a good APY. You will pay none of the usual fees that banks charge, waiving the cost for such things as ACH transfers, excessive transactions, and incoming wires. There also is no monthly fee. Ally is a company that proudly boasts its ability to help consumers save twice as much when using the digital savings tool available. It offers buckets that you can use to create, prioritize, and complete tasks, while boosters are used to increase the funds in your savings account. You can easily add funds to your accounts through recurring transfers that happen each month automatically, taking one more thing off your plate. If you want to build your savings faster, you have the option of a recurring transfer that will round each purchase to the next dollar.

Pros | Cons |

|

|

Axos High Yield Savings Account

Best for easy access to your account

Features and fees

- APY: 0.61%

- ATM card: $0

- Foreign transaction fee: $0

- Incoming wire: $0

- Outgoing wire: $35 domestic / $45 international

- Paper statements: $5

The Axos High Yield Savings Account is a high yield account that boasts one of the highest APYs on our list, topping even the highest APR by one percent. In order to qualify, you must have less than $25,000 in your account to receive this rate, because after that, the rate begins to decrease as the balance grows bigger. Other than that, there are few fees. Axos skips the monthly maintenance fee commonly seen with other banks. You are not required to maintain a certain balance in your account, but you face a $250 fee when you first open the account. It is used to jumpstart your account balance before the monthly minimums are waived. To give you better access to your funds, you can request a free ATM card and then manage both your transactions and savings via the online banking dashboard. Your information is kept secure with biometric identification and advanced safety protocols. Plus, there are also digital money management tools to help you manage your finances, plus automated support available 24/7.

Pros | Cons |

|

|

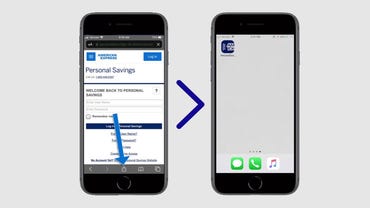

American Express Online Savings Account

Best for customer service

Features and fees

- APY: 0.50%

- Minimum balance: $0

- Monthly fee: $0

The American Express High Yield Savings Account has a higher rate than many banks, and its customer service is well known for its 24/7 service and high customer service standards. Like Ally Bank, there are few fees here with the High Yield Savings Account. Amex does not charge monthly fees, nor does it require an account minimum, so you can save even more. Best of all, it is backed by the power of American Express with the added security of FDIC insurance for your funds. It is important to note that you need to keep some sort of funds in your account because American Express will automatically close your account after 180 days of inactivity. There are also no ATM cards for this account, restricting your access somewhat, but there are both digital and paper statements that you can use to track your account.

Pros | Cons |

|

|

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Capital One Business Advantage Savings Account

Best business savings account

Features and fees

- Excessive transaction fee: $10

- International ATM: $2

- Minimum opening balance: $250

- Monthly service fee: $3

- Out-of-network ATM fees: $5

The Capital One Business Advantage Savings Account delivers an extra bonus with its promotional interest rate of 0.20% that is guaranteed for your first year of having the account. If you maintain a minimum balance of $300 each month, the bank will waive its monthly maintenance fee. There are extra perks from Capital One, too. Account holders also have the option to use Capital One ATMs for free, although there is a $2 charge when you use other ATMs not associated with Capital One. If you have a Capital One checking account, you can link your savings account to provide overdraft protection. Its APY is lower because it is a business account, and you will need $250 at minimum to open your account. Once you open your account, you will have access to account details, as well as exclusive online tools to help you manage your finances.

Pros | Cons |

|

|

Discover Online Savings Account

Best for no fees

Features and fees

- APY: 0.20%

- Bank check: $0

- Excessive withdrawal fee: $0

- Expedited delivery for official bank checks: $0

- Monthly fee: $

- Insufficient funds: $0

- Stop payment: $0

The Discover Online Savings Account claims you can earn in interest over five times the national savings average. It could be because with Discover, fees are few and far between. There are no monthly fees, and you do not have to come up with cash to open the account. You also are not required to keep a minimum balance in your account each month, giving you much greater freedom. However, you have the option to transfer funds from both Discover and other accounts. There is also the option of automatic transfers, which can be set up to run each month based on your instruction. With Discover, you receive 24/7 customer service that is U.S. based for quick help and easy communication.

Pros | Cons |

|

|

What is the best savings account?

Based on our extensive study, the best savings account is the Ally High Yield Savings Account. However, it is important to consider what features and factors are most important to you, so you can find the right match for your banking needs.

Savings account | APY | Recommended Credit | FDIC insured | Minimum opening balance | Monthly maintenance fee |

Ally Online Savings Account | 0.50% | Fair, Good, Excellent | ✔ | $0 | $0 |

American Express Online Savings Account | 0.60% | Not disclosed | ✔ | $0 | $0 |

Axos High Yield Savings Account | 0.61% | Good, Excellent | ✔ | $250 | $0 |

Capital One Business Advantage Savings Account | 0.20% | Fair, Good, Excellent | ✔ | $250 | $3 |

Discover Online Savings Account | 0.60% | Good, Excellent | ✔ | $0 | $0 |

Which is the right savings account for you?

It can be overwhelming trying to decipher each bank account, so we offer this chart based on our expert recommendations.

Choose this savings account… | If you… |

Ally High Yield Savings | Want the full package |

American Express National Bank | Value support from your bank |

Axos High Yield Savings Account | Want a free ATM card |

Capital One Business Advantage Savings Account | Want your business to build its savings |

Discover | Prioritize excellent mobile support |

How did we choose these savings accounts?

It seems like every bank has a savings account today, so it begs the question: how is one to find the very best savings account?

These are some of the factors we considered to find the best online savings account:

- APY: How much interest you earn matters, so we look for companies that offer a high APY to give you maximum growth potential.

- Fees: There are many fees that an account holder can face, like monthly maintenance fees, an opening balance, or even a wire transfer. Be sure to carefully read the fee schedule to ensure that it is right for you.

- Access: Some banks offer ATM cards so you can take out cash, but not all of them do. If you think you will want to access your savings, check to see which banks give you an ATM card upon sign-up.

- FDIC protection: FDIC insurance is very important to secure the funds you put into your savings account because federal law protects up to $250,000 in your savings.

Before you choose the best savings account for you, check out the details of each bank to ensure that everything works for you and meets your needs.

What are the different types of savings accounts?

There are three popular types of savings accounts: money markets, certificates of deposit (CD), and traditional savings accounts, such as the ones illustrated here. Money market accounts add check writing abilities, while CDs hold your money for a specific term, earning interest the whole time. A traditional savings account tends to be the more popular banking option for consumers, but it is always a good idea to explore your options.

What are the major differences between checking and savings accounts?

A checking account keeps funds readily available for use, while a savings account is designed to tuck those funds away so they can earn interest over time – something checking accounts do not typically offer.

Are there alternatives savings accounts worth considering?

To help with your search, these are some other types of savings accounts that almost made our list and may be worth your consideration.

While you round up your search, consider our top picks for the best cash management accounts and the best free business checking accounts for that budding business!

[ad_2]

Source link