[ad_1]

Whether you are an independent tax professional or a CPA working in a large firm, you want to make sure you are using the best professional tax software available. You want software that meets your needs and, above all else, the needs of your clients. As a dedicated tax preparer taking the administrative and logistical burden off of taxpayers who simply don’t have the time or means to carry it themselves, you want to have tax software that provides a high security and efficiency level.

Tax preparation requires constantly keeping abreast of changing tax laws, which have become more difficult in the past two years with the effects of COVID-19. Last year, the federal and state governments have extended filing deadlines, mailed stimulus checks and other forms of aid, and allowed for deferred employer payroll taxes. The tax landscape has changed drastically, but the best tax software will always hold high value under the most volatile economic circumstances.

Here are a few of the industry’s best tax prep software available to professional tax preparers.

Drake Tax

For tax professionals

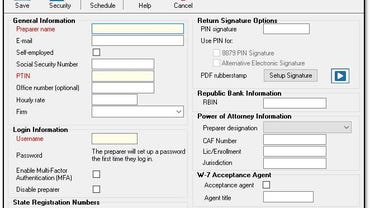

Drake Tax is generally known for being the tax software that offers the best value for tax professionals serving primarily mid-market clients with more complex tax circumstances and some small businesses. It is also known for providing several streamlined electronic filing features, including SecureFilePro. Let’s take a look at why it remains one of the best choices for tax preparers.

Features

Drake Tax is consistently on the list for best tax software because of its ease of use, simple navigation, and highly-rated customer service. Some of its most attractive features include simplified data entry, automatic data flow from various federal and state returns, and automatic forms filing, just to name a few. Various tax-year analyses make Drake Tax a great choice for tax preparers. Features include:

- Extensive filing: Drake Tax supports simple and complicated filers. It is popular among CPA firms with small and mid-size clients and includes all relevant forms, such as 1040 forms, those for partnerships, C and S-corps, trusts and estates, and tax-exempt organizations. Drake Tax supports the following tax forms and schedules: 1040, 1040-NR, 1065, 1120, 1120-S, 1120-H, 706, 709, 990, 1041.

- SecureFilePro and paperless options: SecureFilePro, which has a dedicated paperless feature, allows users to electronically obtain source documents from their clients that they will use in the tax preparation process. E-filing and an e-signature component can facilitate an even smoother tax preparation process that can be done completely electronically.

- Ease of data import: With Drake Tax, users can easily import QuickBooks or Client Write-Up data. This also makes importing spreadsheets quick and efficient.

- Planning and review tools: Drake Tax allows users to compare taxes from one year to the next, making tax planning easy. Archived information is made readily available in the user dashboard, and amortization scheduling is also available. Additionally, Drake Tax has built-in features to prevent oversights that could lead to IRS rejections if you make a mistake.

Pricing options

Drake Tax offers two platforms: A desktop version and a web-hosted version called Drake Tax in the Cloud.

Price range: The desktop version is between $345 and $1,625. Drake also offers the Power Bundle package of Drake Tax 2021 and Drake Accounting 2022 for $1,745.

Intuit ProSeries Professional

Maximize your savings

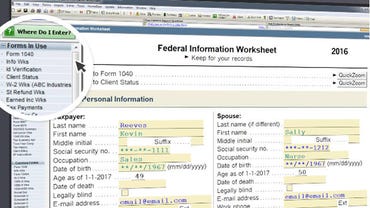

ProSeries Professional is a popular and reliable tax preparation service software created by Intuit. It gives tax preparers the ability to transfer data from QuickBooks, also an Intuit product, to ProSeries Professional seamlessly. The ProSeries comes in two desktop-only versions, ProSeries Basic and ProSeries Professional. Here is a closer look at some of the best features from both.

Features

- Input guidance and forms: K-1 data import automatically transfers data to individual returns. A dedicated forms bar interface allows users to input tax return information, locate errors, and locate the right tax forms with ease. The Intuit link portal makes document collection simple. It allows clients to deliver their tax data and information in a timely and organized manner.

- Entry sheets, data, and e-filing: With ProSeries, quick entry sheets make data entry easier, too, with less scrolling from form to form. Undo and redo features make fixing mistakes easy and painless. ProSeries allows users to view, track the status of, and manage various e-filed returns. Missing client data is also flagged and tracked, linking back to appropriate field locations before a return is sent.

- Client tools and tax planning: ProSeries allows users to create checklists for the items clients need for each year’s tax return. Client-specific billing and editable invoice options are available as well, whether flat rates, hourly fees, or charges per form. ProSeries generates a list of up to 73 tax planning suggestions specific to your client that will help them lower future taxes. The tax planner estimates withholdings, expenses, income, and tax payments for future tax years.

- Hosting and integration: ProSeries software can be accessed anywhere on any device, making it a convenient option for tax preparers who must work on the go. Information is stored in a cloud, allowing flexible workflow no matter where the user is located. Users can manage client signatures electronically with eSignature. ProSeries has streamlined integration across the platform by allowing simple importing of financial data to ProSeries from QuickBooks and TXT. Furthermore, some client data and tax forms, such as 1099-B and 1099-INT, can be downloaded from participating financial institutions.

Pricing options

ProSeries is available in two desktop-only versions, ProSeries Basic and ProSeries Professional.

Price range: The desktop application is between $369 and $1,999. Prices vary depending on packages and pay-per-return.

ATX Tax

Pay-per-return system

ATX is a professional tax software by Wolters Kluwer. It has a vast and comprehensive tax form library with over 6,000 tax compliance forms and business returns, making it a great choice for small- to medium-sized businesses serving corporate and business clients.

Features

- Ease and diagnostics: In past surveys in the Tax Advisor, ATX has rated at the top for “easiest to use” tax software programs. Furthermore, ATX’s robust diagnostic system identifies e-filing errors, overridden entries, and even omissions. Tracking refunds or balances due is easy with the Refund Meter feature.

- Extensive form library: ATX has over 6,000 forms, mostly federal, state, and local returns and corresponding schedules. In addition to specialty returns (706, 709, 990, 550), ATX also houses forms for state and federal sales and use tax.

- Abundant research: Accessing IRS form instructions and schedules is relatively straightforward and simple. Most of the ATX packages include award-winning research resources, such as CCH AnswerConnect and CCH US Master Tax Guide.

- Integration: Important data from QuickBooks Online is easy to import with ATX. ATX integrates with CCH iFirm Portal, offering seamless and secure file sharing of uploaded documents.

Pricing options

Per ATX, the most popular package is ATX MAX for $1,929.

Price range: ProSeries Professional costs between $839 and $4,699, depending on which package you choose. ATX Pay-Per-Return is the least costly, and ATX Advantage is the most costly.

TaxSlayer Pro

Only for tax professionals

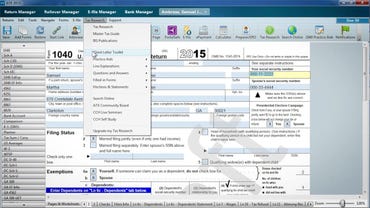

TaxSlayer Pro is the professional version of the commercial product TaxSlayer. It is a great option for independent professional tax preparers and larger firms alike. Currently, TaxSlayer Pro has three plan options: Classic, Premium, and Web. Each edition offers business and individual tax preparation and filing options.

Features

- Business returns and unlimited filing: File business and corporate returns with TaxSlayer Pro federal and state forms. With TaxSlayer Pro, there is no limit to the number of tax returns you can prepare and file. Additionally, there are no charges per return. Complete with a full business suite, TaxSlayer Pro also allows for both federal and state electronic filing for forms 706, 709, 990, 1041, 1065, 1120, 1120-S, and 5500.

- Bank products: With TaxSlayer Pro, refund transfers allow a user’s clients to deduct the tax preparation fees directly from their tax return, resulting in zero out-of-pocket costs for the clients.

- Depreciation module: TaxSlayer Pro has a depreciation module that allows users to easily enter their client’s assets while selecting the correct depreciation method to calculate proper lines on returns.

- Web option: Compatible with iOS, TaxSlayer Pro Web is cloud-based professional tax software. You can access it on any device with a Wi-fi connection, making it convenient to prepare client returns or access the TaxesToGo mobile app. The mobile app allows users to reach more clients no matter where they’re working from. It is a convenient option for tax preparers who have to work on the go.

Pricing options

TaxSlayer Pro pricing varies between the three options.

Price range: Per TaxSlayer Pro’s pricing scale, Pro Classic is $1,195, Pro Premium is $1,495, Pro Web is $1,395. Pro Web and Corporate is also available for $1,795, adding the ability to file corporate and LLC returns with the desktop-based software.

How to choose the best tax software for you

With so many tax preparation software products on the market, it can be a challenge to know which one is the best for you. Some tools are better than others. An independent tax professional or small business owner may be better suited to a different tax preparation software than a CPA working in a large corporate firm.

Like any product you’d buy, you want to Consider your budget, first and foremost. A premium plan may provide more features and forms, but it may not be the best option for you if it is over your budget. Consider what kinds of forms and features you will actually need. Write down a list of must-have forms and features. You may find that a basic software package will suit your needs.

Here are other points to consider when choosing a tax preparation software:

- Would you rather have a dedicated desktop version to work from, or is it important that you be able to work from a cloud service? Consider how much you travel and work on the go.

- Is it important for you to have state returns included in your software package? If so, look closely at each plan because some charge extra for state forms.

- Are you tech-savvy, or will you need a fair amount of support to use the software? Support by chat is the most convenient way to communicate with customer service, but not every package includes support by chat. Do your research.

With ever-changing tax laws and filing deadlines, a tax professional must have quick but efficient software that includes all the necessary forms and filing features. But pricing matters, too. Ultimately, the best tax software is the one that meets all your needs and helps you maintain the most crucial aspect of the job: customer satisfaction.

[ad_2]

Source link