[ad_1]

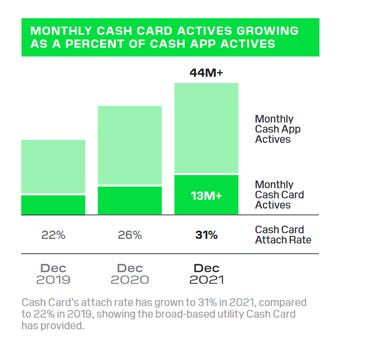

Payments pioneer Block on Thursday reported better-than-expected fourth quarter financial results, as well as momentum within its mobile payment service Cash App. Cash Card, the free debit card connected to a customer’s Cash App balance, has reached “significant scale,” the company said, with more than 13 million Cash Card monthly actives in December. That represents more than 30% of Block’s 44 million monthly transacting active base.

All told, Block’s Q4 adjusted net income per share was 27 cents. Total net revenue in Q4 was $4.08 billion, up 29% year-over-year. Excluding bitcoin, total Q4 net revenue was $2.12 billion, up 51% year-over-year. Bitcoin revenue was $1.96 billion in Q4, up 12%.

Analysts were expecting earnings of 22 cents per share on revenue of $4.03 billion.

For the full year of 2021, adjusted EPS was $1.71. Total 2021 net revenue was $17.66 billion, an increase of 86% from the full year of 2020. Excluding bitcoin, total net revenue for the full year of 2021 was $7.65 billion, up 55% year-over-year.

Block processed $46.3 billion in gross payment volume (GPV) in the fourth quarter of 2021, up 45% year-over-year. For the full year of 2021, GPV totaled $167.7 billion, an increase of 49% from the full year of 2020.

Cash App delivered strong growth in the fourth quarter of 2021, generating $2.55 billion of revenue and $518 million of gross profit, which increased 18% and 37% year-over-year, respectively.

Excluding bitcoin, Cash App revenue was $590 million in the fourth quarter, up 42%. Cash App generated $1.96 billion of bitcoin revenue and $46 million of bitcoin gross profit during the fourth quarter of 2021, up 12% and 14%, respectively.

Bitcoin revenue and gross profit benefited from year-over-year increases in the price of bitcoin and number of bitcoin actives. Compared to the third quarter of 2021, bitcoin revenue and gross profit increased on a quarter-over-quarter basis, driven primarily by increased volatility in the price of bitcoin, which affected trading activity compared to the prior quarter.

For the full year of 2021, Cash App generated $10.01 billion of bitcoin revenue and $218 million of bitcoin gross profit, up 119% and 124% year-over-year, respectively.

Peer-to-peer payments remained the primary driver of customer acquisition in the fourth quarter, Block said. In December, there were more than 44 million monthly transacting actives on Cash App, an increase of 22% year-over-year.

To enhance network effects through other products, in the fourth quarter the company introduced a new feature allowing customers to send fractional shares and bitcoin from their Cash App balances to friends and family.

Meanwhile, the Square ecosystem in Q4 generated $1.47 billion of revenue and $657 million of gross profit, up 49% and 54% on a year-over-year basis, respectively.

Hardware revenue in the fourth quarter of 2021 was $36 million, up 47% year over year, and generated a gross loss of $32 million as Block used hardware as an acquisition tool. Revenue growth was driven primarily by strong unit sales across Square Register, Square Terminal, and third-party peripheral product offerings.

Corporate and Other generated $56 million in revenue during the fourth quarter and $7 million in gross profit. Corporate and Other comprised areas outside our Square and Cash App ecosystems, which was primarily TIDAL in the quarter and full year.

[ad_2]

Source link