[ad_1]

By Ashutosh Joshi

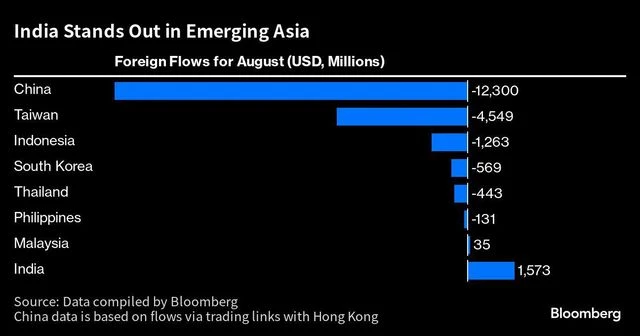

Indian equities stood out in August as foreign investors sold stocks in almost every other Asian emerging market, thanks to the nation’s strong corporate earnings performance and its growing appeal as an alternative to China.

Global funds purchased $1.6 billion of Indian shares on a net basis last month through Aug. 30, according to the latest exchange data compiled by Bloomberg. That’s even as they withdrew a combined more than $6 billion from Taiwan, South Korea and Indonesia. With a small $35 million inflow through Aug. 24, Malaysia was the only other exception.

August also marked a sixth straight month of inflows into Indian stocks. With this year’s inflows, foreigners are now just $137 million shy of reversing their record $17 billion exodus from the nation’s equities in 2022.

)

While this year’s 6.3% gain in India’s benchmark trails its peers in Taiwan and South Korea, the South Asian nation’s stocks remain among the most consistent performers in the region. The NSE Nifty 50 Index is heading for an eighth annual advance. Stocks of small- and mid-sized firms, which are seen as better placed to benefit from the country’s efforts to capture a bigger share of global supply chains, have outperformed in 2023.

“India remains in a sweet spot,” said Amnish Aggarwal, a head of research at Mumbai-based brokerage Prabhudas Lilladher Pvt. Stock markets in India stand out as they offer diversified opportunities along with a fast-growing economy, and this is in contrast to the slowing growth in Europe and the US and many parts of Asia, he added.

First Published: Sep 01 2023 | 11:56 AM IST

[ad_2]

Source link