[ad_1]

PayPal burst onto the scene in 1998 and immediately made a splash in the world of e-commerce. Suddenly, bidding and selling became commonplace due to newfound ease and accessibility. PayPal is internet shopping at its best, with members able to sell new and used goods to a global audience. So, it makes sense that PayPal would have a credit card, too.

Foreign Transaction Fees None

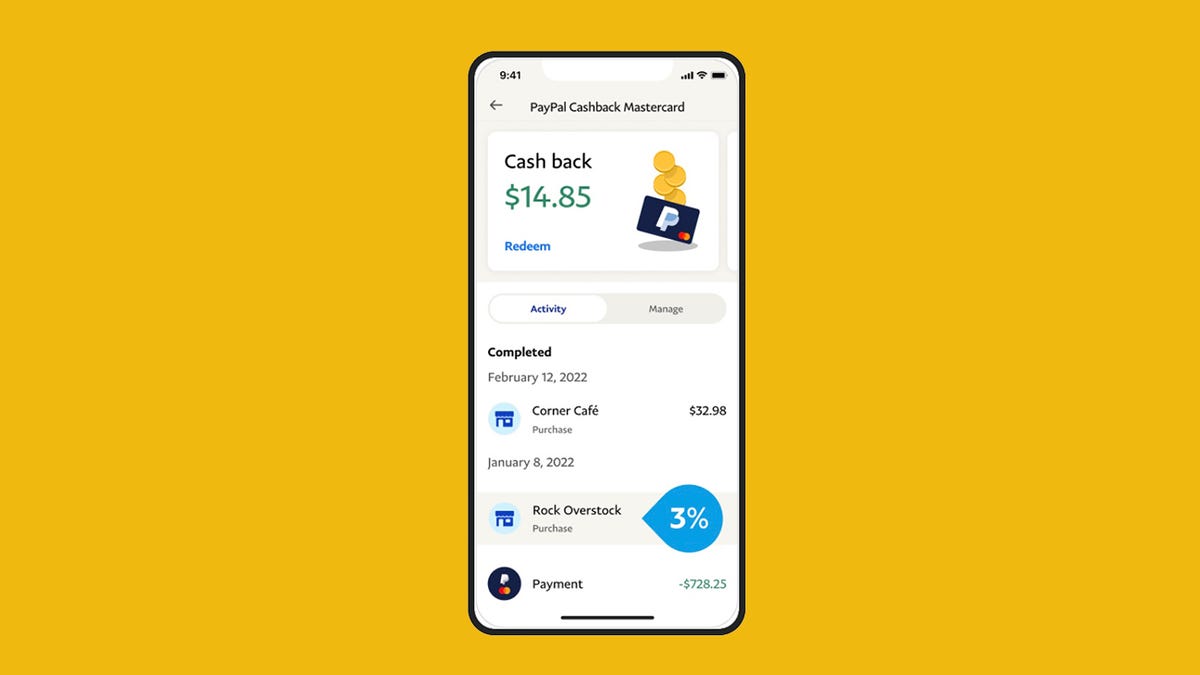

- Earn 3% cash back on PayPal purchases

- Get 2% cash back* every day, every purchase, every time you use your card. No exceptions. No rotating categories to keep track of

Many cards limit the type of purchases you can make or require a certain dollar amount before you can cash in on rewards. That is not the case with the PayPal Cashback Mastercard. With a flat 2% cashback on all of your purchases, you also receive 3% when you shop on PayPal.

Although this new credit card is not yet available to new applicants, cardholders of the 2% Cashback Mastercard automatically receive an upgrade to the new PayPal Cashback Mastercard.

Pros:

- Unlimited rewards with bonus

- No restrictions or categories

- No annual fee

Cons:

- Not yet available to new members

- No introductory APR

- No rewards bonus

What are PayPal Cashback Mastercard’s key features?

Features:

- With the PayPal Cashback Mastercard, you receive unlimited rewards with no maximums.

- Cardholders receive 3% cashback on PayPal purchases and 2% cashback on all other purchases.

- There is no introductory offer or APR for this card.

- It is not yet available to new members, but existing cardholders receive an automatic upgrade.

PayPal is the perfect card for both occasional and habitual shoppers. Absent are the usual tricky and complicated rewards structures. Instead, PayPal simply keeps it nice by offering a flat rewards system. Of course, PayPal favors its own site, so PayPal purchases earn unlimited 3% back. Even if you choose to shop outside of PayPal, you will still receive 2% cashback, making it easy to earn cashback on those everyday purchases, both big and small.

There are no limits and no restrictions, but it is important to remember that the card is not available yet to new cardholders. Instead, existing cardholders are receiving first priority with an automatic upgrade to their accounts.

Is PayPal Cashback Mastercard the right card for you?

The PayPal Cashback Rewards Card can be an excellent fit if you are looking for a credit card that:

- Saves you extra money on the purchases you make every day

- Does not require an annual fee

- Offers a competitive APR

- Gives extra bonuses for PayPal purchases

With its exclusive PayPal rewards structure, this is a card best served for PayPal users, especially because membership is required before you can sign up for the card.

How do you apply for the PayPal Cashback Mastercard?

You must have a PayPal account in order to use the PayPal Cashback Mastercard. It is easy to open an account quickly and for free. To join the waiting list, you simply visit the PayPal Cashback Mastercard website and sign up. You will automatically be notified when you are able to apply.

Existing cardholders will be automatically converted.

What is the APR for the PayPal Cashback Card?

The PayPal Cashback Card offers a trio of interest rates based on your qualification:

There is no introductory offer or APR.

Where can you use PayPal Cashback Mastercard?

Bearing the Mastercard logo, the PayPal Cashback Card is accepted most everywhere for added convenience that will not interfere with that shopping spree.

What bank is the issuer for the PayPal Cashback Card?

Synchrony Bank issues the PayPal Cashback Card.

What are PayPal Cashback Mastercard’s security benefits?

PayPal was subject to a data breach in 2017, putting approximately 1.6 million users at risk.

However, by partnering with Mastercard, PayPal is able to provide cardholders with a slew of benefits and security protections, including Zero Liability Protection for fraudulent purchases, Mastercard ID Theft Protection to monitor your credit score and white-glove ID Theft Resolution.

In today’s digital world, it is that extra assurance that goes a long way.

Does PayPal Cashback Mastercard offer customer support?

There are several ways to receive customer support for your PayPal Cashback Credit Card. Customer support is personalized based on your specific needs.

There are also other ways to receive help:

- A community forum for Q&As from other cardholders

- Resolution Center to help with questionable transactions

When you log in to your account, there are options for more personalized help specifically for your account.

Should you get the PayPal Cashback Card?

With a flat rewards system, the PayPal Cashback Rewards Card makes it easy to earn cashback on everyday purchases. It is not necessarily the best option if you do not use PayPal, but if you are willing to sign up and use your free account, you could earn big rewards on everyday purchases.

It is hard to think of anyone that would not benefit from the PayPal Cashback Credit Card. The APR could be lower, and there is a foreign transaction fee, but unlimited rewards can save you a ton of money and help you buy a few extras, too.

[ad_2]

Source link