[ad_1]

By Anup Roy

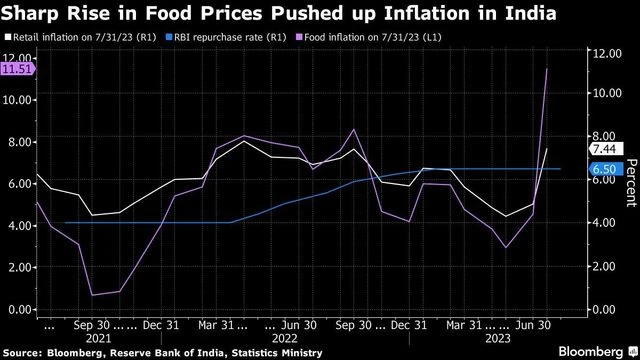

The Reserve Bank of India must ensure there’s no spillover from the surge in food prices, two monetary policymakers said, as the odds for a rate hike begin to build with inflation at a 15-month high.

The central bank is targeting to keep inflation between 2% and 6% but the consumer price index accelerated by 7.44% last month. Food prices, which account for about half of CPI, jumped 11.51% on concerns of supply shortages owing to unfavorable weather affecting crop production.

“The key would be to control food inflation itself,” said Shashanka Bhide, who is one of the six members of the monetary policy committee. “There is a need for ensuring increasing supplies in the domestic market and to the social safety programs.”

India’s government has moved to curb exports of rice and sugar and impose steep taxes on onion shipments to ensure domestic supplies. It has also allowed for tomato imports from Nepal to bring down prices.

Without including food and fuel prices, core inflation is moderating after the RBI raised rates by a cumulative 250 basis points since May last month. The monetary policy committee left rates unchanged for a third straight meeting in August as it looks to see if growth in Asia’s third largest economy comes under pressure.

The policy tightening “is still working its way through the system and this is expected to maintain downward pressure on core inflation over the next several quarters,” said Jayanth Rama Varma, an external member of the panel, in an emailed interview.

The committee “should remain alert to any signs of an uptick in generalized inflationary pressures or any reversal in the downtrend of core inflation,” he added.

Sharp Rise in Food Prices Pushed up Inflation in India

)

Photo: Bloomberg

Bhide said in emailed comments that it was important for India to update the commodity and product weightings for CPI. The indicator’s basket of foods and services was last updated in 2012 and several items are near-obsolete.

Both rate setters are currently tracking the progress of the monsoon season. The “uneven distribution of rainfall spatially and during the monsoon season is a concern,” and will affect demand for those for whom agriculture is the primary income, said Bhide, a prominent Indian agriculture economist.

Nearly 65% of India’s population live in rural areas and their livelihood is mostly driven by agriculture. Bhide expects a “moderate festival uptick in rural demand,” due in part to improved credit opportunities.

Varma said the monsoon risk is “potentially as much of a demand shock as a supply shock” and the rural demand situation needs to be monitored closely in the coming months.

[ad_2]

Source link