[ad_1]

If you’re thinking about ways to make your money work for you or generate more than today’s savings account interest rates can offer, or you want to manage your own wealth, it is worth exploring the opportunities investment apps offer.

Investment is no longer just in the realm of pensions or locked away on Wall Street. Instead, as the GameStop shares incident highlighted, retail investors now also have huge collective power in the stock market.

It’s not all about so-called “meme” stocks, though, which can be extremely risky. Mobile investment apps, instead, can be used to monitor and manage typical trades including individual stocks, mutual funds/ETFs, ISAs, SIPPS, and other types of pensions, and more. You also don’t always need to manage your stocks personally, depending on your preference.

Below, ZDNet has compiled a list of the top investment apps to consider in 2022.

Fidelity

Best investment app overall

Features: No account fees, no minimum deposit

Fidelity is an excellent option for both professional and retail investors. The brokerage’s app, available on iOS and Android, offers individual stocks and shares as well as bundles, such as socially responsible funds or index funds, to explore. There are also useful news feeds, a goal planner, and Fidelity offers commission-free trades of ETFs and shares to retail investors.

Pros:

- Investment tools

- Straightforward pricing structure

Cons:

Nutmeg

Best for long term savings, ISAs

Features: Fully managed portfolios

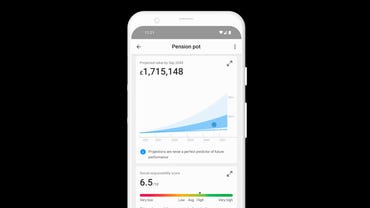

Nutmeg is my personal favorite for long-term investments in ISAs. One for UK investors and accounting for over 185,000 users, the Nutmeg app can be used to manage general investments, ISAs, and pensions. You can set goals, investment styles, and how comfortable you are with risk. You can also choose to have your funds managed. Nutmeg invests in index funds, ETFs, and by country and sector.

Fees vary by portfolio, whether managed, socially responsible, or based on fixed allocations.

Pros:

- Fully managed portfolios are an option

- Regulated by the FCA

- User-friendly

Cons:

- Need substantial deposits to open new ISAs (£500)

- Fees

Robinhood

Best for fractional investing

Features: Minimal amounts required to invest

Robinhood is an interesting option as the platform has a vast share portfolio to choose from — and users can purchase fractional shares, which isn’t very common. Say you have $5 — you can buy a fractional share of a stock that costs far more, or you can contribute toward a unit in an ETF, drip-feeding your investments over time.

You can also explore margin calls and cryptocurrency, and you can start with as little as $1.

You should keep in mind, though, that Robinhood’s platform has faced controversy, not in the least due to how the company handled the GameStop share ramp.

Pros:

- Easy access to investment at any fund level

- Possible to buy fractional shares

Cons:

- User trust has suffered a blow

eToro

Best for adding cryptocurrency to your portfolio

Features: Stocks and cryptocurrency trading under one roof

eToro markets itself as a tool for the “social” investor by copying the moves of other traders. The broker has a clear pricing structure and offers users the chance to snap up fractional shares, but the app, arguably, is more geared toward offering both stocks and crypto, rather than being a master of one — and so stock options are somewhat limited.

The app has an emphasis on cryptocurrency trading and facilitates access to coins including Bitcoin (BTC), Ethereum (ETH), EOS, and Dogecoin (DOGE).

You can start with $10.

Pros:

- 0% commission, fractional shares

- Access to a range of cryptocurrencies

Cons:

- Limited stock and ETF investment options

Ameritrade

Best for experienced investors

Features: In-depth market data and guides

TD Ameritrade’s brokerage app is an excellent option for the more experienced investor who wants access to in-depth market research, news, and movement charts. The app offers access to stocks, options, and ETFs, as well as the option to create real-time alerts and watch lists.

Ameritrade’s pricing structure now includes 0% commission and some free online stock trading. However, fees may come into play for broker-assisted trades, options, futures, and other types of investment.

Pros:

- Real-time market tools and updates

- Transparent pricing

- No account minimum

Cons:

- Beginners may experience a steep learning curve

- No fractional shares

What is the best investment app?

We consider Fidelity the best brokerage apps on the market today. The platform combines valuable guides for beginners, more advanced market research and points of interest for experienced traders, and a transparent and easy-to-understand pricing structure.

Investment app | Beginner friendly? | Android and iOS? | Fees? |

Fidelity | Yes | Yes | Yes — but generally commission-free.Fees applied to bonds and options. |

Nutmeg | Yes | Yes | Yes — Various |

Robinhood | Yes | Yes | Yes — but commission-free |

eToro | Yes | Yes | Yes — 1% in crypto trades; Various |

Ameritrade | No | Yes | Yes — but commission-free; Various for options, broker-assisted trades |

Which is the right investment app for you?

You should consider several factors when are you deciding on one, or more, investment apps to download. Whether or not you want to strike out on your own as a beginner and learn as you go, explore cryptocurrency trading, or whether you want a service that offers to manage your portfolio, keep in mind that all investment comes with risk and you should only invest what you’re comfortable with outside of necessary expenses and general savings.

Choose this investment app… | If you want… |

Fidelity | A feature-packed trading app for the long term |

Nutmeg | Managed savings/investment |

Robinhood | Investment on a budget |

eToro | To explore cryptocurrency |

Ameritrade | Access to in-depth market data |

How did we choose these investment apps?

Today’s mobile apps are developed with ease of use and functionality on smaller screens in mind. We chose apps that have proven track records and at least reasonable access to different forms of trades, funds, and investment opportunities across the leading mobile OS ecosystems. We also made sure to include apps suitable for beginners alongside more professional traders.

What is the best way to start investing as a beginner?

At a time of meme stocks — the ramp-up of stocks such as GameStop — cryptocurrency, and NFTs, it’s easy to get caught up and swept away in the prospect of tenbaggers, get-rich-quick punts, “just buy my course for $5000 and make $100,000 in a week on the stock market” shills, and signing up for investments without doing any prior research.

The stock market has inherent risk and as a general practice, it’s not recommended to put more in than you can afford to lose. So, if you’re unsure where to begin, you might want to consider stocks and shares accounts that are managed for you (for a % fee), trackers, index funds, or ETFs that don’t require you to select individual shares.

How many stocks should I hold?

it is often best to keep your portfolio diverse. This can lower your overall risk of loss in the stock market. By holding a variety of stocks, funds, and other ventures (even if held in one mobile app), you are lessening your risk of “over-exposure” to sectors, industries, or countries that could experience a downturn.

There’s no magic number beyond what you feel comfortable with. Some suggest between 10 – 15 is a ‘sweet spot’ for beginners, whereas 20 – 30 is also pegged as a general comfort level. It all depends, however, on your own level of investment, the time you intend to hold stocks, and how much risk you are willing to shoulder.

Do I need to pay tax on my investments?

Generally, investing in stocks and shares involves paying capital gains tax — and this includes profit generated from dividends based on your investment funds which need to be reported on tax returns. Losses may be deductible.

Accounts may also have different tax rules: for example, a pension account (such as a SIPP/IRA) might require a draw-down and tax liabilities that only hit after you can access the funds; whereas a UK stocks and shares ISA is tax-free with contributions of up to $20,000 per year.

Are there any alternative apps worth considering?

While deciding on the best products on the market, we have accounted for expertise level, short and long-term investments, and fees. However, you can also consider:

[ad_2]

Source link