[ad_1]

There are few financial tools that can dig us out of this catastrophe — but there may be a scant few resources out there that can help lessen the strain.

Getty Images

The cost of living crisis in the United Kingdom is now in full swing, and the government appears reluctant to step in. Budgeting, now, isn’t about saving — it’s about survival.

We expected an increase in prices, at the least following COVID-19. The pandemic had a severe impact on supply chains, some products were impossible to get such as toilet paper, and businesses that barely made it through the lockdown yo-yo now had to work out how to repay the coronavirus bounceback loan.

The general public — including many individuals who were on furlough and receiving smaller payments or lost their small businesses or jobs entirely or fell through the cracks of support schemes for being “Ltd” company directors — now has its freedom.

However, opening the cage door hasn’t solved the personal and small business debt accrued through the pandemic, the mental health problems, the general level of exhaustion, or the anxiety of having to process and deal with COVID-19’s impact and the increase in the cost of living.

As noted by financial expert Martin Lewis, there are few financial tools that can dig us out of this catastrophe — but there may be a scant few resources out there that can help lessen the strain.

Table of Contents

What’s causing the UK cost of living crisis?

No single factor has led to a crisis of this magnitude. This is a combination of the pandemic’s impact, the energy price cap lift, debt, rising taxes, inflation, the rising cost of goods and services, and, I would argue, a lack of governing balance supporting growth and tackling ground-level living problems.

Due to the pandemic, economic uncertainty, and war, Brexit has had a wider impact than, perhaps, the separation from the EU would otherwise have had. With less of an economic buffer available, the economy feels the sting.

The energy crisis: Nothing good to say

Martin Lewis, the founder of MoneySavingExpert, has advocated for consumer rights for years and has been in talks with the Office of Gas and Electricity Markets, or Ofgem, concerning the price cap and household struggles.

Lewis apologized earlier this month for saying Ofgem’s changes are a “f—ing disgrace that sells consumers down the river.” However, the sentiment is likely widespread, and there appears to be little political intervention to assist households.

Ofgem determines the energy price cap, the default £/per kWh tariff you are placed on if you are not on a fixed deal, you choose a standard variable tariff, or your supplier goes bust and you are moved to a supplier of last resort.

The price cap went up by £693 on April 1 and the next is expected in October.

“Those on default tariffs paying by direct debit will see an increase of £693 from £1,277 to £1,971 per year (difference due to rounding). Prepayment customers will see an increase of £708 from £1,309 to £2,017.” — Ofgem, concerning the last price cap increase

This figure is based on wholesale costs and other factors, and was updated every six months, although Ofgem is considering an update every three months. The proposed changes, including “market stabilization charges,” mean that, in short, prices could go up more frequently and there is little chance of cheap, fixed deals appearing on the market.

On May 24, the regulator warned that the next increase, set to come into play in October, will likely rise to £2,800. With the current cap at £1,971, this is a price increase of roughly £900.

Jonathan Brearley, Ofgem’s chief, told the BBC that this could plunge 12 million households into fuel poverty. He also warned that the energy cap could rise further if Russia decides to withhold energy supplies due to the imposition of sanctions following the country’s invasion of Ukraine.

There’s nothing good to say about energy. Considering all the factors: rising wholesale costs, the number of UK energy firms that have gone bust, and the surging price cap, many consumers will struggle — whether on direct debit or prepayment meters.

So far, the government has refused to impose a windfall tax on oil or gas firms, although pressure is mounting. With the next hike, many households can only hope that assistance will be offered.

Tax changes, cuts, and freezes

- National Insurance (NI) threshold: The NI starting point has been increased to £12,570 a year.

- Health and social care levy: A 1.25 percentage point increase in NI payments from 2023. Businesses, Ltd firms, and sole traders need to prepare now.

- Minimum wage: the National Living Wage has increased to £9.50 from April 1, 2022.

- Fuel duty: A 5p cut in duty, although prices are still surging.

- Universal Credit cuts: The additional £20 a week, given to benefit claimants during the pandemic, has been cut.

- Student loans: The repayment threshold has been frozen at the 2021-22 level of £27,295 per year, or £2,274 a month. In real terms, this means many students will pay back roughly £150 more per year.

- Income tax: The UK personal tax-free allowance will stay at £12,570 for the next four years and the basic rate of income tax will eventually be reduced from 20% to 19%. In real terms, we’re likely to pay more over time.

- Benefits: No major changes or increases. If you consider inflation, over time, claimants will have less disposable income.

- Council tax: Councils have been allowed to increase their rates.

Food prices skyrocket

On May 11, the National Institute for Economic & Social Research (NIESR) warned that economic destitution would hit a further 250,000 UK households in 2023, bringing the total number of those in “extreme poverty” to roughly 1.2 million.

The think tank told The Guardian, “More than 1.5 million households will see the rise in food and energy bills outstrip their disposable income, forcing them to rely on savings or extra borrowing to make up the shortfall.”

The governor of the Bank of England, Andrew Bailey, told Sky News that “apocalyptic” food prices are on the horizon, with cooking supplies such as sunflower oil and wheat — of which Ukraine and Russia are major suppliers — in high demand and low supply, contributing to the problem.

It’s not just the Russia-Ukraine war, however. As noted by poverty campaigner Jack Monroe in this Twitter thread, it’s the price increases of individual items in our shopping basket, over time, that will have an impact on our poorest households. Increasing inflation will only put more pressure on households, while shops may have to charge more due to limited supplies and rising fuel and logistical costs.

Monroe noted:

“This time last year, the cheapest pasta in my local supermarket (one of the Big Four), was 29p for 500g. Today it’s 70p. That’s a 141% price increase as it hits the poorest and most vulnerable households.”

I’ve noticed that a small food shop now appears to be at least £20 or £30 more expensive than before, and no doubt, others have encountered the same thing.

While Tory MP Lee Anderson has suggested that food bank usage is due to “generation after generation” who “cannot budget” and “cannot cook properly,” a Trussell Trust survey suggests that one in 10 parents may have to visit a food bank in the next three months, with the cost of food and energy being contributing factors.

Fuel prices remain high

Motorists have had it far from easy recently. Despite a 5p cut in fuel duty, prices continue to reach extremely high levels, impacting the general public and businesses alike. Extinction Rebellion protests and blockades at refineries in April have also contributed to fuel supply problems.

The Automobile Association’s (AA) latest report (April 2022) on average fuel prices is below:

Petrol

- Highest: The South East has recorded the highest price for unleaded at 163.4 p/litre.

- Lowest: Northern Ireland has recorded the lowest price for unleaded at 160.0 p/litre.

Diesel

- Highest: The South East has recorded the highest diesel price at 177.4 p/litre.

- Lowest: Northern Ireland has the cheapest diesel at 171.8 p/litre.

In comparison, the AA’s April 2021 report recorded highs of 126.3 p/litre (petrol) and 129.1 p/litre (diesel).

Inflation keeps climbing

At the time of writing, the UK has reported an increase in inflation to 9%. It is forecast to reach at least 10% this year. What this means, simply, is that the value of the UK’s currency is lowering as the general price of goods and services increases — hitting your pocket and disposable income.

In other words, the £20 note in your pocket won’t stretch as far as it did this time last year.

Mortgages and rent

Estimates suggest that the average rental price has increased by 11% year-over-year. Zoopla says that the average single earner loses 37% of his or her paycheck to rent alone. Prices are climbing the most in London.

Homeowners are now looking at fixed deals whenever they can switch, as the increased interest rate and tracker agreements out there could see them pay more.

One thing after another

UK residents are experiencing the knock-on impact of the pandemic’s aftermath, rising inflation and increases in food, services, fuel, and energy costs, combined with potential tax hikes, student loan repayments, and more expensive housing. Combine that with little government assistance, and many of us are, frankly, up the creek.

How are people coping?

3 in 4 think the government is not providing enough support – Ipsos

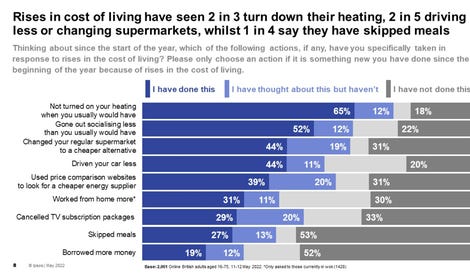

A survey conducted by Ipsos on behalf of Sky News, of over 2,000 adults in Britain reveals some of the tactics people are using to try and cut down their monthly expenditure.

Among the findings:

- 65% say they are keeping the heating off when they otherwise would have turned it on.

- 52% are socializing less.

- 27% have skipped meals due to financial problems, rising to a third in self-reported lower incomes.

- 44% are driving less.

- 44% have switched supermarkets for cheaper alternatives.

Responses to the cost of living crisis, Ipsos survey

Ipsos

According to the survey, most Britons expect the cost of essentials, including utilities, fuel, and food, will continue to rise in the next six months.

“Britons across the country see the cost of living as both a national, local, and personal priority,” commented Gideon Skinner, head of political research at Ipsos. “People are already telling us they have taken a range of actions to mitigate its effects — some with a direct impact on basics like food and heating — but given the economic forecasts, there may well be more anxiety on the horizon.”

What does budgeting mean now?

If we’re being honest, budgeting now more often means “surviving” rather than “saving.” With outgoings appearing to increase month-on-month and households sliding down the quality of life scale, being able to budget in 2022 may become nothing more than plate spinning with the hope one of them doesn’t crash to the ground.

CreditSpring estimates that the UK is set to borrow an additional £9 billion on credit cards over the next six months to survive the cost of living crisis.

There aren’t many tools or services out there that can help in such a situation, and relying on “Spend this % on food/entertainment a month” charts just don’t cut it right now.

However, it’s still worth discussing what help is available and how you may be able to cut down on some expenditures.

Tips to help you weather the crisis

1. Energy and direct debits (DD): Providing monthly readings can reduce the amount you are being required to pay instead of relying on an energy supplier’s estimate.

There are cases where energy providers are requesting ridiculous direct debit increases — in my own case, for example, my provider tried to nearly triple my DD — and you can often challenge this. The cap went up by roughly 54% and standing charges appear to also have gone up, but these companies still need to justify huge increases.

2. Should I cancel my direct debit? I know of some people who have gone down this route to just “pay what they owe.” However, customers who are not on direct debits are often charged more.

You can also try to claim back cash if you think you’ve been overcharged.

Some council taxpayers will be receiving a £150 rebate toward their energy costs in council tax bands A – D. If you fall outside of this bracket, you can contact your local council, which may have discretionary funds available to help.

Furthermore, there will be a £200 cut to energy bills in October. However, we all will need to pay this back.

3. Dealing with outstanding debts: Debts can be incredibly stressful. It can be a scary prospect to find out exactly what you owe, and where, but this means that you know where you stand and you might be able to work out deals with creditors.

For example, I recently helped someone with their debt. They were terrified at the prospect of looking at their credit report, but once we did, we found the amount was far less than they thought. We’ve been able to work with some of the creditors and have cut some of the debts by over half. Now, a small monthly direct debit is in place, and they can sleep better at night.

Ignoring debt might not take a toll on your wallet right now, but it does take a toll on your peace of mind.

4. Dealing with bills and debt disputes: If there are any disputed bills, whether for energy, vehicles, or otherwise, you might want to try and tackle them now.

If you find yourself getting stonewalled, you can also consider reaching out to Citizen’s Advice and potentially the Ombudsman service if you think the debt you are being pursued for is wrong or unfair.

You should also take the time to check your bank accounts and see if there are any old recurring payments to cancel.

5. What is the Ombudsman?

The Ombudsman service is a last resort if you’re getting nowhere when trying to resolve a demand for payment.

This service may be able to help with issues including disputes regarding energy bills or mobile and broadband payments.

As a personal example, I was once chased for a £550 debt from an energy firm, which had sold the debt on — twice — to a collections agency. I was never a customer and the debt was actually accrued by my former landlady and was registered to her address. Despite my protests and supplying all the evidence required, I was still being pursued, month after month. The moment I mentioned the Ombudsman, my name was removed from the file and I never heard from them again.

Keep in mind that first you have to try to work with a company or supplier before you can call upon this service to escalate a complaint. However, if you are getting nowhere and the company refuses to engage, the Ombudsman can intervene on your behalf and demand not only financial compensation but also an apology.

The Financial Ombudsman deals with small businesses and business complaints.

6. Balance transfer cards: It could be the case that more of us than ever will rely on credit cards as the cost of living crunch sinks its teeth further into the UK.

Managing by debt, if possible, isn’t recommended, as this just delays the problem — and as the cost of living is likely to continue to increase for some time, you could get into more financial arrears.

However, when used carefully, balance transfer cards can save you from paying multiple interest payments on multiple credit cards. This can reduce the monthly amount you have to pay back and simplify your payments. You can move multiple balances and consolidate them on one card, for example.

When you choose one, be aware that many balance transfer cards will only have a low or 0% APR for a limited time, such as three or 12 months. So, when that time comes to an end, you could potentially have to repeat the process with another card.

It’s about time management and chipping away at debt, but you will likely pay a low percentage transfer fee, so consider this initial cost, too.

As an example, I walked a friend through this method. He has approximately £4,500 in credit card debt, works in health care, has recently had to move back in with his parents, and has been struggling to make repayments on multiple cards. We found a card that will take on most of this amount with a small transfer fee and 0% APR for 12 months, leaving him with this card and a smaller debt on another.

In an ideal world, the spare cash would go to paying off this debt more quickly, but in reality, it’s being used to help cover his spiraling fuel costs to get to and from work. It’s not a complete solution, but it’s something to give him breathing room.

7. Are you paying too much council tax? Council tax bands were introduced in 1991 and were based on the property’s value. However, the system is full of errors and the wrong band assignments are common. You can check this guide on how to challenge your band and see if you have been paying too much — and if you are due a rebate.

Around four years ago someone living in a property close to me challenged their band — and as a result, I received a surprising but welcome rebate notice in the post as my own band was changed.

A word of warning: this can also go the other way and not in your favor. It can potentially impact your neighbors and they may not be too happy with you if you lose your case and their council tax increases, as well as yours.

8. Check your benefits: Low-income households, the disabled, working families and pensioners may all be entitled to different benefits. It’s worth using a benefits calculator to make sure you are receiving the benefits you are due.

9. Marriage tax allowance: If you aren’t using your personal allowance in full, the amount you are allowed before you pay tax, you might be able to transfer £1,260 to your wife, husband, or civil partner, thereby slightly reducing the tax they pay.

10. Check your local council for support: Local councils may be able to support you. They may also have grants and awards available for community projects.

11. A point on water bills: You should check to see if your property has a soakaway. It’s not commonly known, but if you do and your wastewater is not going back into the grid, you can apply for a cost reduction on your bills.

Additional resources

Resources for parents:

Pets and vet care:

Other money saving links of interest:

Food apps that can help save money

There are some mobile apps and online services that may be useful to you in the months ahead.

- Too Good To Go: When a cafe, restaurant, or shop is done for the day, they may have surplus food that will only go to waste. Millions of users signed up to this app can grab “magic bags” made up of food at the end of the day for a hefty discount. iOS | Android

- Olio: Connect to locals to share unwanted food and household items. iOS | Android (you can find out if your city is active on this map.) Tesco is in partnership with this app.

- No Waste: You can use this app to document the food you have at home, sort items based on expiry dates, plan meals, and potentially reduce waste. iOS | Android. // alternative: nosh

- Wowcher: Hit and miss, but you can sometimes find decent deals on food and drink, whether to stock up the fridge or for a special occasion. iOS | Android

- Whisk: meal planner and recipe importer. iOS | Android

- Yummly: recipes and smart shopping lists. iOS | Android

Food banks

Food banks are in extremely high demand. The Trussell Trust, an operator of food banks nationwide, says that over 2.1 million food parcels were distributed between April 2021 to March 2022.

The charity has provided a map for those in need to find their local food banks.

Citizens Advice has also provided a guide for those on low income, or who are struggling, on how to apply for and use a food bank.

Financial advice agencies and non-profits

- Talking Money: Talking Money is an independent charity that provides financial advice to struggling individuals, including debt management, energy problems, and benefits applications. Appointments are available as well as face-to-face meetings in Kingswood.

- PayPlan: Debt management advice

- StepChange: This is one of the best resources out there if you feel overwhelmed by debts. Advisors can help you work out what you owe and offer advice, and in some cases, may be able to help you consolidate debts and become debt-free as quickly as possible. The organization also has a 60-second debt test to determine if you could benefit from help.

- Money Advice Trust: The Money Advice Trust charity runs several services, including the National Debtline. The National Debtline can hold your hand and allow you to negotiate with lenders. Phone calls and web chats are part of the free service and if you find yourself unsure of how to take control of outstanding debts, they can also help you with sample letters or setting up debt management plans & debt relief orders, bankruptcy, as well as rent arrears. Web chats are open Monday to Friday 9am-8pm and Saturdays 9.30am to 1pm.

- Citizen’s Advice: Citizen’s Advice is a huge organization offering advice on everything from debts to service complaints, law, and housing.

- Debt Advice Foundation: The DFA is a debt education and support charity including budget resources and debt calculators.

Who should I contact for..?

Mental health services and resources

2022’s financial pressures have built on the stress and anxiety many of us suffered during the pandemic. The UK government’s COVID-19: mental health and well-being surveillance report found deterioration in mental health and wellbeing, with ‘up and down’ changes that coincided with the lockdown periods and high numbers of COVID-19 cases.

In a subsequent survey conducted by BMO of 2,000 UK adults, 28% of respondents said the cost of living crisis had harmed their mental health, with finances, rent, house prices, interest rates, and energy cited as current concerns.

We may continue to see a decline in overall mental health over the next year. If you feel overwhelmed, you may wish to reach out to the services below:

- Anxiety UK: support and wellness groups

- Depression UK: self-help, community support

- Mind: How to access crisis teams

- NHS urgent mental health helpline

- Campaign Against Living Miserably (CALM): CALM operates a helpline (5:00 pm – midnight, 365 days a year) and a webchat, answers questions, community clubs, and provides guides for topics including what to do if you’re worried about friends or family and their mental health status.

- Mental Health Forum: The MHF operates forums for users to anonymously talk about their mental health.

- SANE: SANE provides support over email, phone and text.

- Nightline: Nightline is a service for students, run by students, offering confidential peer support.

- Family Action: Social, practical and emotional support services in the UK for adults struggling with their mental health.

- Men’s Sheds Association: A men’s health and wellbeing organization for local community hubs and reducing isolation, loneliness.

- Mental Health Foundation: guides, content and podcasts

- Samaritans: 24 hours a day, 365 days a year, you can call the Samaritans team to have someone listen, no matter what crisis you are facing.

- Suicide Prevention UK: Suicide Prevention is a charity for anyone who needs help with their mental health or has thoughts of suicide. The team will provide a listening ear and can point you in the right direction for support services.

[ad_2]

Source link