[ad_1]

There are many types of credit cards out there, but an unsecured credit card is what we traditionally think of when we think of an unsecured credit card. In fact, most credit cards are unsecured, giving you plenty of options when you need a new credit card. You still need credit to apply and receive approval, but the requirements all depend on the card you choose.

If you are considering getting a new credit card, an unsecured credit card could very well be the card for you.

What is an unsecured credit card?

An unsecured credit card is one that does not require collateral or deposits in order to receive the card. Upon approval, you receive a specific line of credit that allows you to purchase items with your credit card. It is a revolving line of credit, which means that you are given a specific credit limit. As you spend, you make payments to stay within your limit. Based on your credit, you receive an interest rate that allows you that applies on purchases you do not pay right away.

With an unsecured credit card, you can have the ability to pay for your purchases later either in full or in installments pre-assigned by your credit card issuer. These cards can bear the Visa or Mastercard logo, giving you greater spending power.

Who should get an unsecured credit card?

There are many times an unsecured credit card could be an excellent choice.

- Good or excellent credit: Unsecured credit cards rely upon your credit score in order to receive approval, so it is usually important to hold a good or excellent credit score.

- Emergencies: An unsecured credit card can be a great choice to keep on hand in case an emergency expense comes up, such as a medical bill or home emergency.

- Rewards: Many unsecured credit cards offer rewards when you reach a certain threshold of purchases. The dollar requirements and type of rewards vary, but you could earn anything from cash back to travel perks when you apply for a rewards credit card.

The Chase Sapphire Preferred Card and American Express Gold Card are among our top picks for the best unsecured credit cards.

What kind of credit do I need for an unsecured credit card?

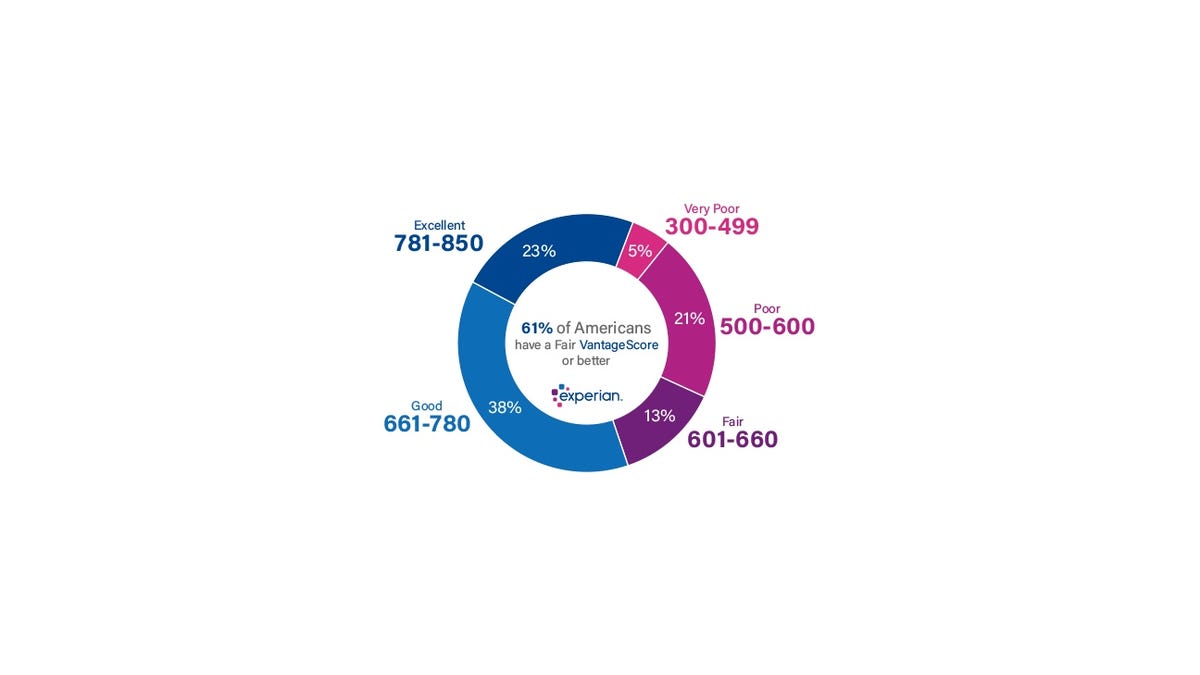

Unsecured credit cards are generally best for those with good or excellent credit, meaning a credit score between 661 and 850. When you have a high credit score, it shows credit card issuers that you have a history of making responsible and timely payments. It is possible to receive an unsecured card with a lower credit score, but these cards are generally accompanied by multiple or astronomical fees that may not make these cards worth your while.

If you have a poor credit score, you are likely better off selecting a secured credit card instead, which gives you a line of credit in exchange for a deposit.

Experian

What are the pros and cons of an unsecured credit card?

Just like anything else, there are both pros and cons to an unsecured credit card. These are a few that may be worth your consideration.

Pros | Cons |

|

|

How do I get an unsecured credit card?

To get an unsecured credit card, it is important to shop your options and compare different credit cards.

Once you are ready to apply, there are certain pieces of information that the credit card issuer will require, in addition to your credit score.

- Personal details, such as your name, address, and date of birth

- Social security number

- Annual income

You can typically apply online for most unsecured credit cards.

What are the best unsecured credit cards?

Several banks and financial institutions offer unsecured credit cards. Some popular providers of unsecured credit cards include Capital One, Discover, and newcomer Petal.

We regularly survey today’s leading credit cards to find the best unsecured credit cards for your needs.

Our latest study includes these high-rated credit cards:

Choose this unsecured credit card… | If you are or want to… |

Capital One Platinum Credit Card | Build credit |

Capital One QuicksilverOne Cash Rewards | Unlimited cashback |

Discover It Student Cash Back | Students |

Petal 2 Cash Back No Fees Visa | No credit |

Credit One Bank Platinum Visa for Rebuilding Credit | Bad credit |

Also: The 5 best unsecured credit cards: Bad credit? No worries

[ad_2]

Source link