[ad_1]

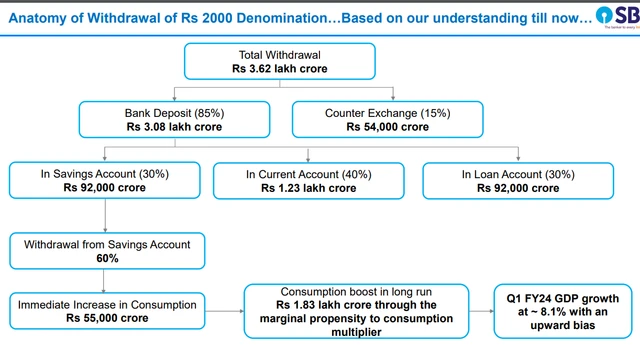

This means that currency in circulation has declined less when compared to Rs 2000 notes deposits in banks (85% of Rs 1.8 lakh crore Rs 1.5 lakh crore). It has declined from Rs 34.78 lakh crore as on 19 May 2023 to Rs 34.08 lakh crore as on 9 2023, a decline of only around Rs 70,000 crore.

Had the entire Rs 1.5 lakh crore/ 85% of Rs 1.8 lakh crore were deposited and not exchanged, the CIC should have declined even more implying that this could result in not only a bank deposit boost but also a boost for repayment of loans and consumption.

“As per our estimate consumption demand may be frontloaded by Rs 55,000 crore. With the bank note remaining a legal tender, unlike demonetisation, consumption could see a boost. Though, RBI asked customers to deposit or exchange the Rs 2,000 notes, but it is expected that high-value amounts could move to high-value spends such as gold/jewellery, high-end consumer durables like AC, mobile phones etc, and real estate,” the SBI report said.

• Cash on delivery: People have also started ordering items online with the cash-on-delivery option. It is reported that nearly 75% of Zomato’s users opting for cash-on-delivery have been paying with Rs 2,000 notes. Ecommerce, food and online grocery segments are likely to witness an increase in customers opting for cash on delivery.

Gold jewelry sales rose by 10-20% when RBI announced the withdrawal of the Rs 2000 notes while people stepped up purchases of daily essentials, and even premium branded goods.

“In the primary housing market (apartment sales), there would be minimal impact of the Rs 2,000 note withdrawal. This is largely because maximum new launches in the recent past years have been by branded developers who prefer their cash registers clean and transparent. Use of cash transactions or black money on the whole had reduced in the primary market since DeMo in 2016. This move is, in fact, a clear indicator that the government wants to further tighten the noose on unaccounted money. It will bring more transparency to the resale market. There is a small possibility that we may see some increase in land deals involving this denomination,” said Prashant Thakur, Sr. Director & Head – Research, ANAROCK Group.

)

“Considering the MPC of this Rs 55,000 crore at 0.7, we believe that the Private Final Consumption Expenditure (PFCE) might increase by Rs 1.83 lakh crore through the multiplier effect. Considering that ratio of PFCE to GDP at constant prices is around 58 per cent, we may expect Q1 FY24 GDP growth at 8.1 per cent with an upward bias due to the impact of this Rs 2,000 note withdrawal event. This reinforces our projection that FY24 GDP could be higher than 6.5 per cent, per the RBI estimate,” the report said.

[ad_2]

Source link